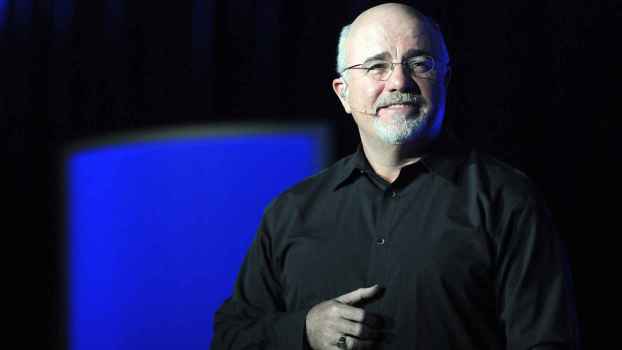

Why Dave Ramsey Hates Car Payments Even if You’re Loaded

Some say that Dave Ramsey’s harsh judgment of people with car loans is just misplaced anger. After all, 2024 is already full of incredible financial pressure for the middle class. It’s hard to pay any amount of the cost of a car in cash. However, a closer look at his feedback loop on car payments might be, well, good advice. Moreover, Ramsey doesn’t just judge regular folks for signing up for a years-long car loan. He tells rich people to cut it out, too.

Most commonly, you’ll see TikToks floating around of Ramsey on his show. The vids repeatedly display how annoyed he gets when he sees luxury cars or hears about a car note.

On The Ramsey Show, Dave often rehashes how he believes car payments hold people underwater.

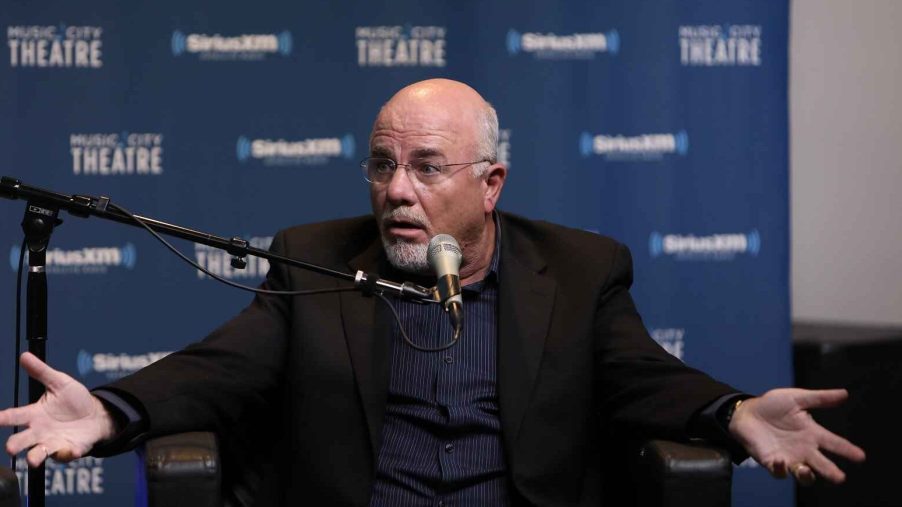

Critical comments suggest Ramsey is out of touch on how difficult it is to avoid car payments. However, last fall, a wealthy digital marketing company owner made Ramsey almost hysterical over his car payment.

The caller claimed to be paying $3,200 per month in car payments. After Ramsey nearly had a meltdown over the number, he asked for the details. The caller explained that he drives a Rolls Royce Ghost. “I guess!” Ramsey exclaimed.

The guest shared that he made an incredible $320,000 monthly before taxes. That adds up to $3,800,000 per year.

Ramsey goes on to ask how old the caller is. “I’m 24,” the guest responds. “That’s just insane,” says Ramsey.

While Ramsey congratulates the caller, he still comes through with his unwavering hatred for car payments.

“Listen, write a check, and pay for the car. And smile while you’re driving it.”

Why the sore attitude? The same reason he hates credit card debt: interest. To Dave Ramsey, loan interest is a total waste of your money. After all, you’ll spend more money over time than if you hunkered down and planned ways to avoid a car payment.

While it might be a huge challenge, avoiding entering a car loan in the first place is the safest bet. For those who already have one, strategizing how to get into a lien-free vehicle as quickly as possible is challenging but usually possible with some “grit.” At the very least, having the smallest car payment possible on a highly reliable, low-maintenance vehicle helps.