Report: Feds Want to Track EVs to Tax Them Based on Miles Driven

As electric car sales increase, states’ revenue decreases. That’s because every state and the District of Columbia charges a gasoline consumption tax that’s part of the gas price to pay for road improvements, signage, bridge repairs, etc. So EVs are also in the spotlight to determine how they should pay. Now the feds are looking at ways to track you to charge taxes based on the number of miles driven. Does the country need an EV tax?

Do EV drivers want to be tracked?

We get it. All states are dependent on gas taxes. So getting EV owners to pay their fair share is coming, one way or the other. A recent study predicts a loss of $67 billion by 2050 just from cars being more fuel efficient. Part of that efficiency, obviously, is from hybrid and EV adoption.

But monitoring you and your car may not go down well, with those disapproving of the government keeping a big eye on where you go. A reasonable question is, “Why can’t the tax be like it is for gasoline?” That would mean charging by the amount of electricity used at the source, which is an electric charger.

What states charge an EV tax for charging?

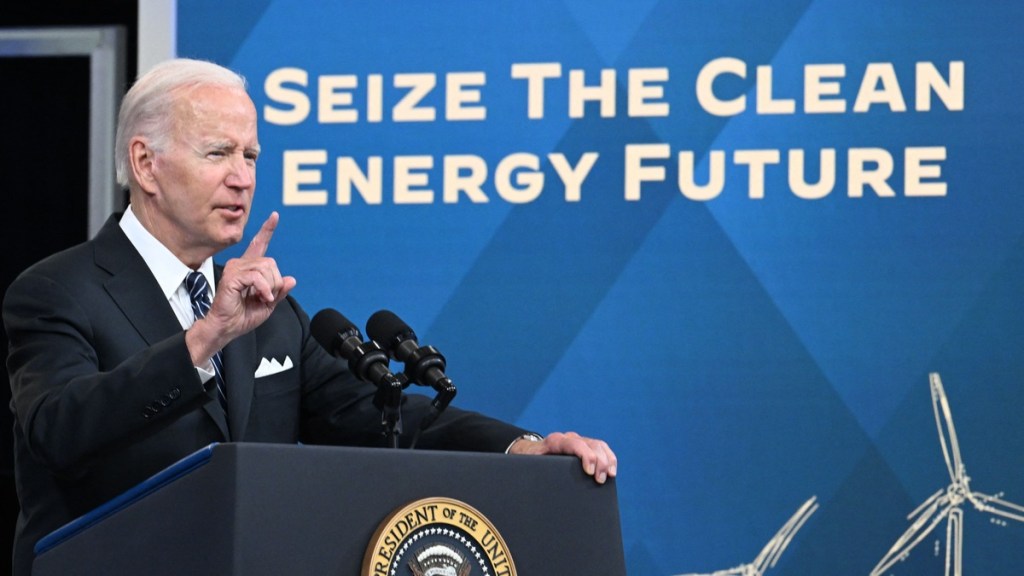

Fortunately or unfortunately, depending on which side you’re on, three states have pilot programs that the U.S. government is funding. The funds come from the Biden infrastructure legislation, with $125 million earmarked. The states participating are Oregon, Utah, and Virginia, with Hawaii joining soon.

Other states have taken matters into their own hands. Colorado adds 27 cents to Amazon and similar home deliveries. Others, like Texas, charge extra taxes for EV registrations or add taxes at public charging stations. Still, others are experimenting with electronic tolls.

Why hasn’t there been a successful EV charging program?

But tracking new cars is the one getting the research funding and the government’s eye. Many legislatures are monitoring Virginia for several reasons. First, it is the largest program of the three states. But more importantly, because it sits in a cluster of geographically smaller states, it provides a better model for EVs going from one state to the next.

Eric Paul Dennis, a transportation analyst in Michigan, told AP, “There’s no program design that I have seen that I think can be implemented at scale in a way that is publicly acceptable. That doesn’t mean that a program can’t be designed to do so. But I feel like if you can’t even conceive of the program architecture that seems like something that would work, you probably shouldn’t put too much faith in it.”

Why did Washington State kill its EV charging bill?

Washington State tried to implement EV mileage fees through voluntary owner submissions of miles driven. But the governor vetoed the legislation, saying the state needs a program before implementing personal data collection. So to Dennis’ point, there doesn’t seem to be any program worth implementing to begin charging taxes with.

Most EV owners made their purchases for the environment and energy savings. Most surveyed agree they need to pay their fair share. So we’ll see how the feds and states can coalesce around an environmental program balancing funding needs with the need for privacy.