The Majority of People With Expensive Car Payments Could Soon Be in Trouble

Most people can’t afford to purchase a vehicle outright. Fortunately, financing has become a common part of the car-buying process. However, depending on the length of the loan, interest rates might increase soon (if they haven’t already).

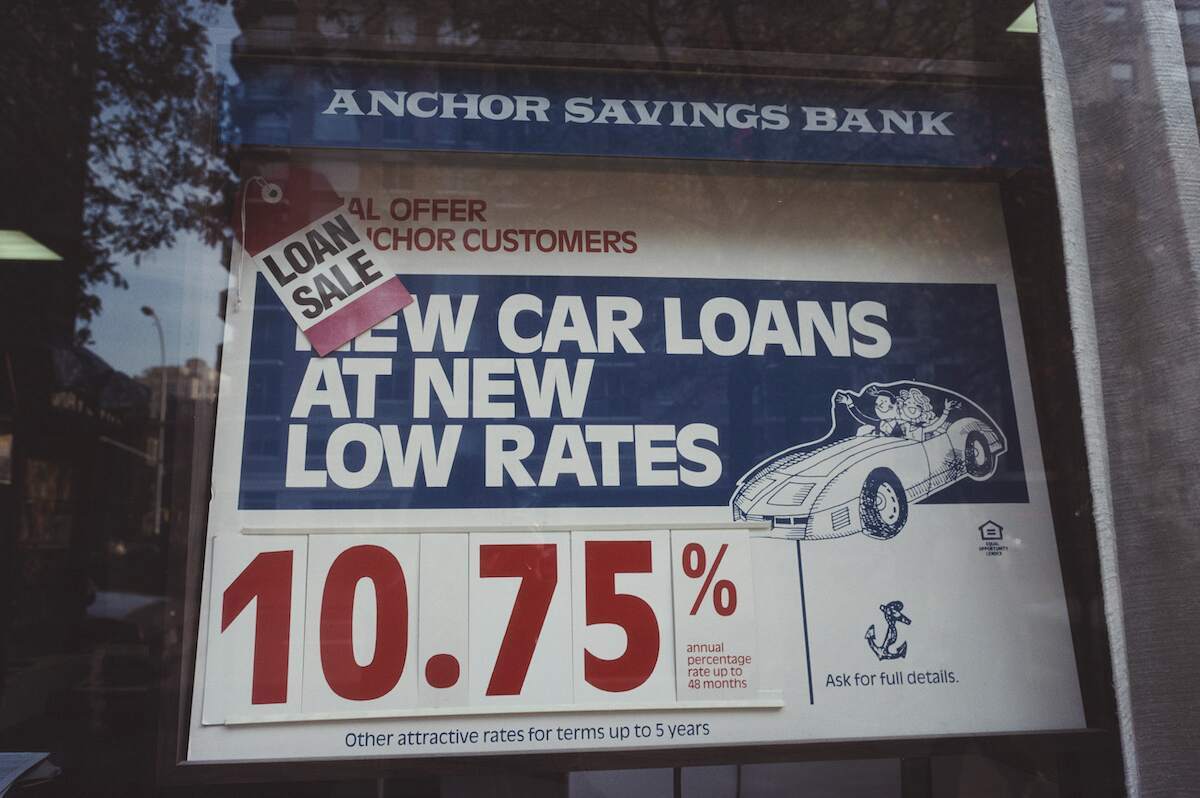

Car loan premiums and interest rates are on the rise

Over 17% of consumers spend $1,000 or more on car payments each month. That’s nearly 13% more than what drivers were paying three years ago, Edmunds reports. The average monthly car payment is $733, a little over $50 more than in previous years. Interestingly, the average amount for a vehicle purchase has hovered around $40,000 since 2019.

Interest rates are directly responsible for these premium increases, with the average APR at 7.1%. Those rates depend on the loan’s length, with longer terms resulting in higher rates. Of the vehicle owners who pay over $1,000 in monthly premiums, 64% have APRs ranging from 8.5% to 9.6%. That equates to a loan term of at least 67 months.

The average financing amount requested for a used car is around $30,000. That money is usually collected over six years, with an average monthly payment of around $550. That number seems reasonable until you look at the average APR — a whopping 11%.

However, Edmunds’ data shows drivers who opt for shorter loan terms pay less overall. If you sign up for a four-year loan, your APR could be as low as 2%. However, only 16% of drivers choose this route instead of a longer-term repayment plan.

Is financing a car a bad idea?

As interest rates continue to climb, many consumers face a greater chance of going upside down on their car loans. “Upside down” means when the owner pays more than the car is worth by the end of the financing period. That risk is even greater when buying a new car, which depreciates faster than a used vehicle. Luxury cars are even worse in this regard, with many losing around 60% of their value within the first five years.

If you find yourself in this situation, it might make more sense to roll over that loan toward the balance of a different car. However, that might cause you to lose even more money depending on how much you’ve already spent.

How can you avoid going upside down on a car loan?

Car shoppers should pay close attention to a loan’s estimated APR before signing an agreement. If the ones offered by a bank are too high, consider obtaining a loan through a credit union instead. Buying a vehicle with a lower depreciation rate will also keep you out of holding negative equity on your car. Most Toyota SUVs, such as the Highlander and RAV4, hold their value far better than segment averages.

If you can’t afford to make large monthly car payments within a shorter timeframe, consider paying more upfront. A larger down payment leaves less money that can accumulate interest. And if you can pay off your loan sooner, ask the lender about making additional or larger payments without penalty. You can also consider a cheaper vehicle or look for out-of-state dealerships with lower prices.

Most important, ensure you’re in a good place financially before you take out an auto loan. Although there are some situations where you can unexpectedly go upside down on a loan, you can usually avoid that with careful budgeting.