Tesla Smashes Competition In Over-The-Air Updates

Over-the-air updates for electric vehicles make improvements instantly, and ongoing. Without ever having to take it in to a dealer for repairs, or for that matter even go out to the garage. It’s instant, effortless, and part of the EV allure. All of the EV manufacturers incorporate it into their EVs, marketing, and future plans. But it is Tesla that smashes the competition in those over-the-air updates.

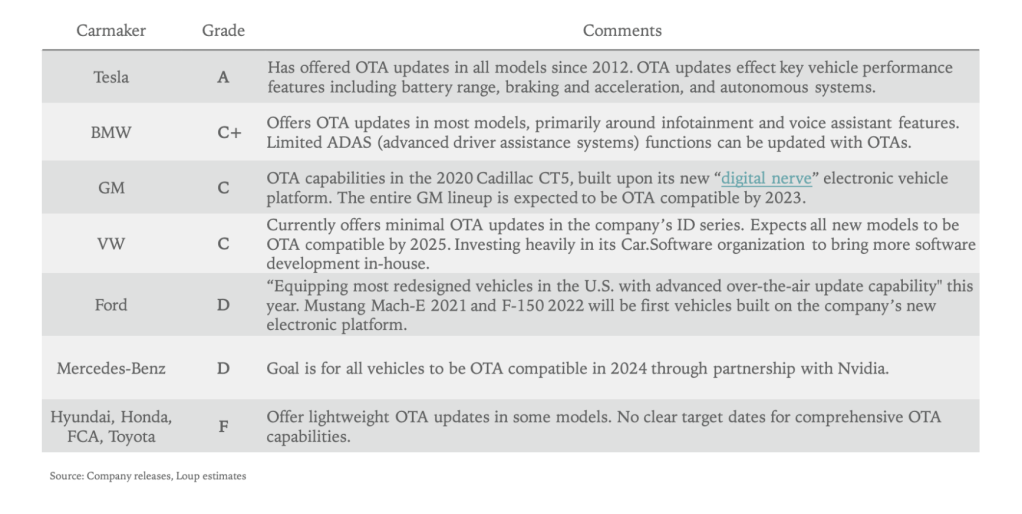

How can this be claimed? Because Loupventures, a tech research firm, has put together a scorecard of the EV manufacturers that incorporate OTA updates. What it found was that other than Tesla most other manufacturers only offer infotainment system OTAs.

Infotainment systems are limited to deal mostly with maps and other convenience features

Infotainment systems are limited to deal mostly with maps, entertainment like Apple CarPlay, Bluetooth, and other convenience features. Tesla’s OTAs also update and fix infotainment-related features, but it does much more. Tesla OTAs also update or improve range, autonomy features, braking and acceleration functions, and safety systems.

Loupventures estimates that the other manufacturers are 3-5 years behind Tesla in offering these OTA updates. That’s because the capability for the software to be controlled must be built into the computer systems during development. The Tesla electrification, connectivity, and autonomous functions were all built into the systems right from the beginning.

Just in the past two years, Tesla has incorporated OTAs to increase range, power, acceleration capabilities, improve braking, and even rolled out the beta version of FSD or Full Self Driving capabilities. FSD was launched to a hand-picked group of tesla owners earlier this year. It will be sent via OTA by the end of 2020.

Here’s the scorecard for the 2020 EV manufacturers:

It is interesting to note that some of the big players in manufacturing like Toyota, Honda, and Hyundai, have extremely limited OTA capability. And those companies don’t have a clear path toward OTA capability like Tesla currently affords. So it’s clear that Tesla is ahead of the legacy manufacturers by a clear margin.

Tesla recently gave a roundhouse accounting of what categories its OTAs can contain. They include “software algorithms control traction, vehicle stability, the acceleration and regenerative braking of the vehicle, climate control, and thermal management, and are also used extensively to monitor the charge state of the battery pack and to manage all of its safety systems.” Tesla buyers want and consider these added values that come with ownership.

It works both ways. Data retrieval and algorithm improvements help Tesla improve the software. That, in turn, helps to improve the product when these OTAs occur.

Legacy manufacturers rely on over-the-shelf EV components

Legacy manufacturers have relied on over-the-shelf EV components manufactured by other companies for their EV vehicles. These are companies like Waymo, Cruise, Argo, and NVIDIA. Since these components don’t incorporate the same features as Tesla has built into its proprietary components they can’t offer the same OTA features as Tesla.

When you stand back, Tesla is an electronics manufacturer that happens to build EVs. Legacy manufacturers are manufacturers that assemble EVs. Since Tesla manufactures software, that means it sells software.

Loupventures estimates Tesla will see $1.1 billion in deferred software income next year

Loupventures estimates that Tesla will see $1.1 billion in deferred software income next year. That will go up to $1.5 billion the following year, and soon after see high-margin revenue matching operating income. So Tesla is in the driver’s seat for the immediate future as other legacy manufacturers struggle to play catch up.

And to think that GM had all of this in the palm of its hands when its first EV1 EVs were introduced in 1998. As short-sighted and short-profit-focussed as GM became it must make its accounting and forecasting departments crazy to think about.