The gas guzzler tax is an extra surcharge that’s added to the sales or lease prices of vehicles that are rated by the Environmental Protection Agency (EPA) to have poor fuel economy ratings. The tax varies depending on each vehicle’s efficiency and can range from $1,000 to $7,000. What’s interesting, though, is up until now, the gas guzzler tax has only been reserved for passenger cars. However, it could be used on SUVs, crossovers, and trucks in the future.

How does the gas guzzler tax work?

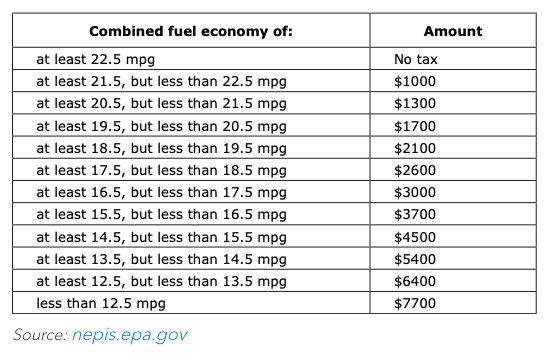

According to EVadoption, the gas guzzler tax is based on a vehicle’s combined city and highway fuel economy value, which must be greater than 22.5 mpg. Every automaker is required to calculate their car’s fuel economy values before sales begin every year and then follow the EPA’s regulations to determine the tax for each application model. The actual tax amount is determined after each model year production cycle and is based on the number of gas-guzzling vehicles sold that year.

Once that figure is calculated, the overall tax amount is paid by the manufacturer or by the importer. Here is a breakdown of the fuel economy ratings and their taxable amounts:

Why doesn’t the gas guzzler tax include passenger trucks and SUVs?

The gas guzzler tax is assessed on new passenger cars, but since trucks, minivans, and SUVs were prevalent in 1978 – when the tax was enacted – those vehicles are currently exempt. That doesn’t really make sense, does it? The folks at EVadoption think that not including passenger trucks, minivans, and SUVs was an oversight on the EPA’s part, especially considering they currently make up for a large part of the market share of vehicles sold today. In fact, in 2019, trucks, minivans, and SUVs made up 70% of all new light-vehicle sales.

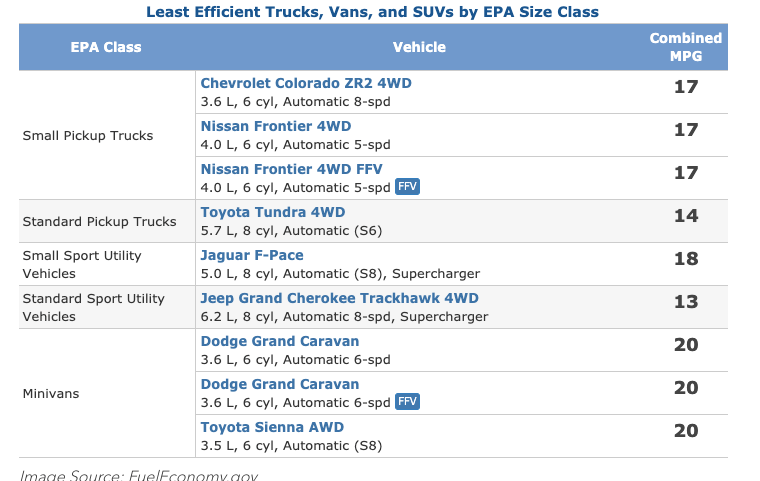

Additionally, pickup trucks, minivans, and SUVs typically achieve lower fuel economy figures than nearly any passenger car today. Here is a table showing the least fuel-efficient vehicles produced in the U.S. in 2018 – as provided by the EPA:

Another issue is vehicle weight, SUVs are heavier and thus less fuel-efficient than passenger cars, so it only makes even more sense that the gas guzzler tax applies to them.

Will the gas guzzler tax ever apply to passenger trucks, minivans, and SUVs?

We think so, although, it might not be too applicable for most cars in the future considering that all new cars sold must average 40 mpg starting in 2026. EVadoption echoes these sentiments and even proposes a few suggestions on fixing/improving the gas guzzler tax:

- The tax must include SUVs, minivans, and trucks

- The MPG threshold should be increased to 25 mpg for cars instead of the current 22.5 mpg and 18 mpg for trucks and SUVs

- Increase the threshold by 1 mpg every two years

- Include a weight component to the tax to add an additional penalty for heavier vehicles

- Create a “Cash for Clunkers” type of program to redistribute the money collected from the gas guzzler tax to drivers that have replaced their older cars with newer, more-efficient vehicles

These are all exceptional points considering the whole purpose of the gas guzzler tax is to keep automakers from building less fuel-efficient vehicles. It only makes sense that larger vehicles on the road should face some type of penalty if they are not up to par with U.S. standards of fuel efficiency. However, considering many automakers are leaning toward building hybrid and electric vehicles in the future, the gas guzzler tax could become obsolete altogether. Only time will tell.