Can I Finance a Car Without a Job?

If you don’t have a job but need a car, then you might feel stuck in a rut. You could possibly rent a car from Turo and get by for a month or two, however, those fees add up over time. Buying a car would be the best course of action, but can you buy a car without having a job?

Other sources of income could assist in obtaining an auto loan without a job

Being unemployed can hinder your ability to obtain an auto loan, but it’s still possible. Credit Karma notes that you can still get an auto loan if you’re unemployed, but you’ll need to show lenders that you have some type of income. In that case, the following types of income could help you qualify for a loan:

- Social security

- Pension

- Alimony

- Investment dividends

- Rental property

If you receive income monthly from any of these sources, then you will want to note that on the credit application when applying for an auto loan. If you don’t have any extra income sources, then you may be able to rely on your credit.

A co-signer can improve your approval odds

If you don’t have any extra income to note down on a credit application, then having a co-signer can help your cause. A co-signer is typically a close friend or family member with an income and good credit that can go in on the loan with you. By doing so, they’re agreeing to take on the payments if you are unable to. As you can imagine, this agreement can pose a great risk to your co-signer, so you may want to weigh the pros and cons first before both of you sign on the dotted line.

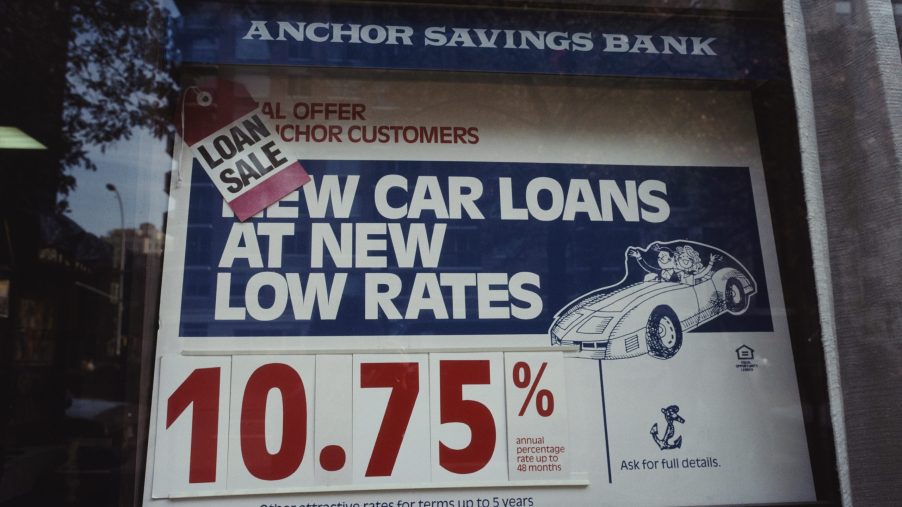

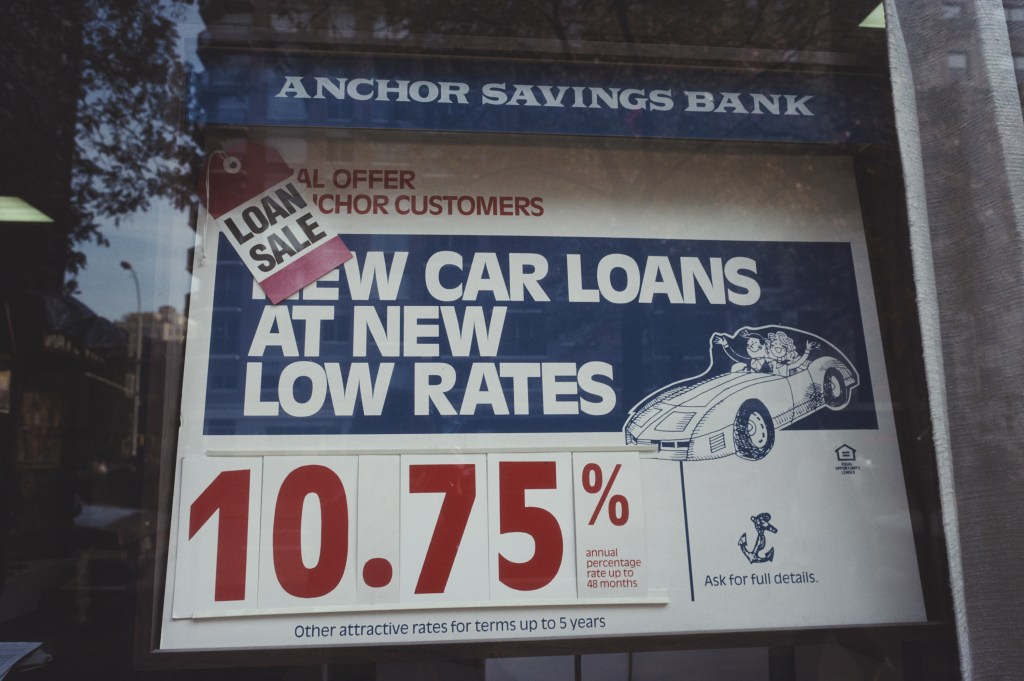

Lenders like to see large down payments if you don’t have an income

Another important factor when applying for an auto loan is the down payment. The larger the down payment the better, especially if you’re unemployed. Typically, a 10% down payment is good, however, if you don’t have an income, then some banks may want to see a down payment closer to 20% when financing a car.

An added plus is that a larger down payment will allow you to pay the car off faster. For example, if you received a 6% interest rate on a five-year loan for a $15,000 car, then you’ll end up paying $2,400 in interest. But if you put down a 20% down payment of $3,000, then you’ll only pay $1,920 in interest, which is a savings of $480.

Having a good credit score can help

As always, the banks will factor in your credit score and history, even if you have a co-signer. The higher your score and the more robust your credit history, the better. However, if you don’t have a good score or have some blemishes on your credit report, then you may be a little more reliant on your co-signer.

Ultimately, it is possible to obtain an auto loan if you don’t have a job. Just keep in mind that you may be hit with a higher interest rate. However, it could take a good credit score and an extra nice co-signer to help you get it.