Struggling With High Car Payments? These 5 Solutions Can Ease the Financial Burden

Having a high monthly car payment is not that uncommon nowadays, especially considering the average monthly car payment is $729. However, just because something is common, it doesn’t mean it’s right. A high monthly car payment can lead to a lot of financial stress, leaving you not knowing what to do. If your car payment is currently sitting at $729 or above, it could be a good idea to try out one of these five solutions.

1. Trade your car for a cheaper one

If you’re currently financing a pricey car you can’t afford, you can look into trading it in for a cheaper one. That doesn’t necessarily mean you must trade your Mercedes-Benz S-Class for a cheap old Honda Civic – although it would be ideal. But it does mean that you can look into trading your $50,000 car for a $20,000 one.

In that case, don’t be afraid to look at the used market and find a car that can better fit your budget. You will be surprised at how affordable some slightly used cars are. By trading your car in, you may be able to get into a lower monthly car payment as well.

2. Save up a larger down payment

If you have not purchased a car, we suggest saving your money for a larger down payment. No, you shouldn’t get a loan for the down payment. Instead, try setting aside more money every month (that you can comfortably afford) so you can put down 15 to 20% of the car’s price. Doing so will greatly decrease your monthly car payments and ensure you won’t get financially stuck later on.

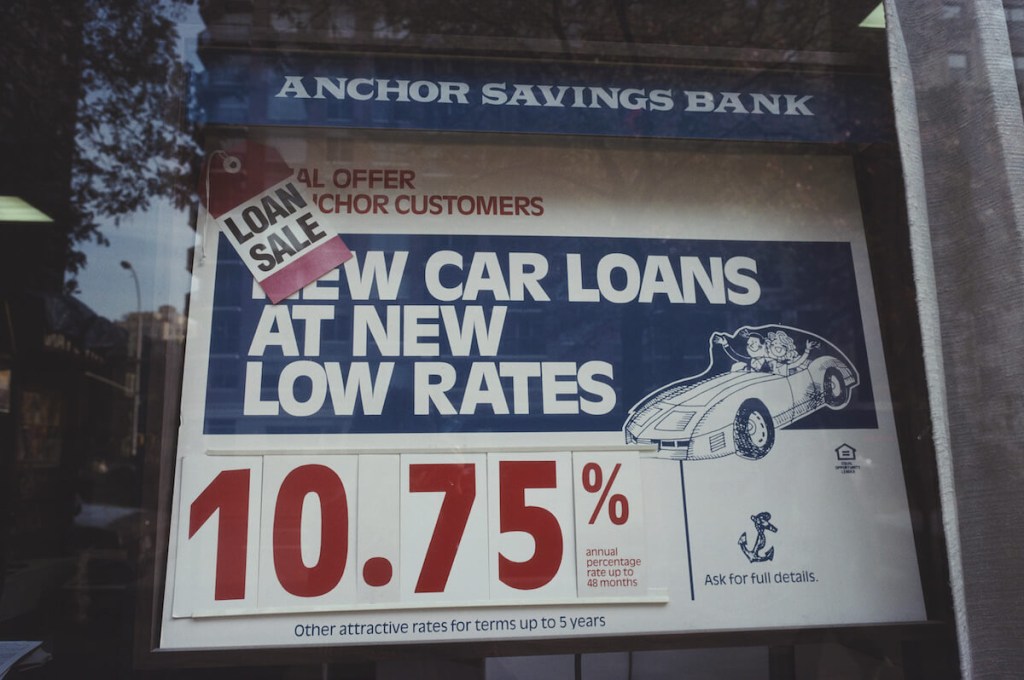

3. Refinance your car loan

One of the most effective ways to lower your monthly car payment is to refinance the auto loan. You’ll need a good credit rating to get a better interest rate, and refinancing comes with a longer loan term. That means you could have the debt for longer. However, if you need to lower your monthly payment, a quick call to your lender could be all you need.

4. Extend the loan repayment term

Whether you have a current auto loan or are planning to finance a car, opting for a longer loan repayment term could lower the monthly payment. A longer loan term spreads out the monthly payments, which makes them lower, but it will also result in paying more interest over time.

5. Talk to your lender about a loan negotiation or hardship program

If you can’t afford your high monthly car payment, it’s a good idea to reach out to the lender and negotiate the repayment terms. According to Yahoo Finance, “You might be able to negotiate with your current lender for a lower monthly payment or new interest rate. This strategy is most successful when you’ve already tried other methods, have a good track record of making on-time payments, and have a proven financial hardship.”

Pay no more than 15% of your monthly income for a car

Here’s a bonus tip — if you haven’t purchased a car yet, make sure your car payment is no more than 15% of your monthly take-home pay. For example, if your take-home pay is $60,000 per year or $5,000 a month, your monthly payment should not exceed $750.

The best way to ensure that you don’t buy a car that’s too expensive for your monthly budget is not to buy an expensive car in the first place. If you’re shopping for a used car, check out how to compare used cars when shopping.