4 Types of Roadside Assistance Plans: How Do They Compare?

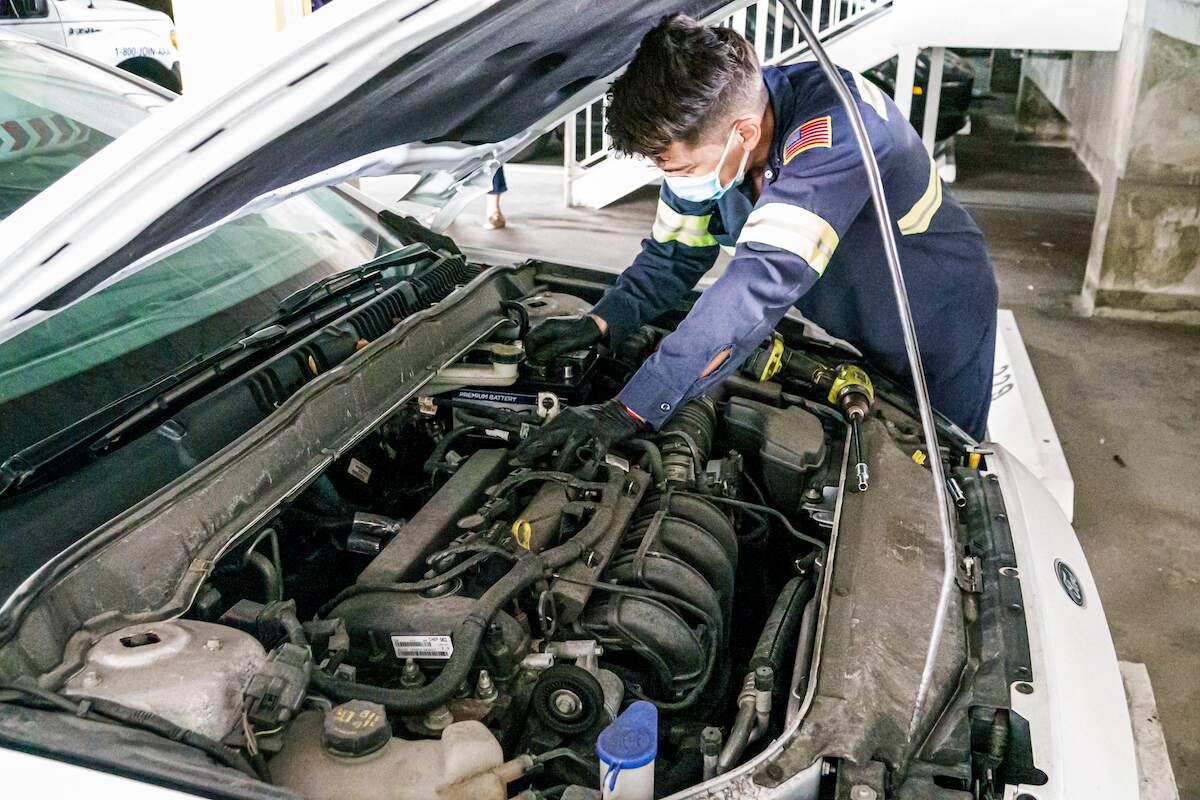

Locking your keys in the car, running out of gas, or getting a flat tire can be frustrating. Without help, you could miss work or an appointment. Roadside assistance can provide invaluable services like quick tire changes, fuel delivery, battery replacement, and towing. Here’s a roundup and comparison of roadside assistance plans to help you decide which type best suits your needs.

1. Car manufacturer-provided roadside assistance plans

Some automakers provide free roadside assistance with a new vehicle purchase, or the consumer can add a package for an extra charge. Typically, these programs last for a couple of years or the length of the factory warranty.

This type of roadside assistance plan is good for budget-conscious consumers, but the coverage usually limits towing to only authorized dealerships instead of the nearest auto shop.

Consumer Reports recommends purchasing an additional full-service plan that covers towing to other locations in case the closest dealership is closed.

2. Full-service roadside assistance plans

Full-service roadside assistance plans offer a broad range of benefits and travel discounts. The most popular providers are AAA, Good Sam, Better World Club, and AARP. Each offers different membership tiers with increasingly more services.

For example, AAA charges around $60 annually for a roadside assistance membership that allows four service calls a year for minor mechanical issues and a five-mile tow limit. Consumers can pay up to $160 annually for coverage that includes 100 miles of towing. Prices vary depending on the region and promotional discounts.

When comparing plans, look at the towing limits, the number of service calls permitted each year, winching capabilities, and if a technician will perform onsite repairs. Also, check to see if the coverage extends to family members or when you’re a passenger in another person’s vehicle. Also, consider the availability of a locksmith, trip interruption benefits, and the total annual cost of the roadside assistance plan.

3. Auto insurance-provided roadside assistance

Most auto insurance companies offer roadside assistance plans that can be added to your premiums. They’re generally cheaper than full-service programs, and some plans cover all insured cars and drivers.

Forbes says Erie Insurance Company’s program is the best. “Erie’s price for roadside assistance is significantly lower than competitors analyzed, and its plan includes minor mechanical repairs and has no service call limit.” The plan costs $5 and includes a 20-mile towing limit.

Although the low price of insurer-provided roadside assistance plans might be appealing, check the fine print to ensure service calls do not count as claims that could result in higher insurance premiums.

4. Auto services through credit card companies

Some credit card companies offer roadside emergency services as a cardholder benefit. However, they typically charge a flat fee per incident. For instance, Visa charges as much as $80 for each service call. And although credit card–provided roadside assistance plans are typically free, they do not offer comparable benefits and discounts found with full-service providers.

Don’t forget road rangers in an emergency

Roadside assistance programs can be lifesavers when the unexpected occurs. However, if you don’t have a plan, and your friends and family don’t pick up the phone when you call for help, you might have another option. Road rangers in some areas travel expressways, so you can summon one to your location by calling or texting a posted number.