10 Car Frauds that Mostly Target Old People

Scammers today have an endless bag of tricks, especially when it comes to attacking senior drivers. They exploit trust through various schemes, from phony repairs to staged accidents. Here’s a rundown of ten common scams and some tips to help you stay vigilant and avoid being taken advantage of!

Staging “Accidents” to Collect Insurance

Some fraudsters stage minor crashes, often a small rear-end bump, and then act like they’ve done serious damage. They’ll claim to be injured, hoping you’ll pay up fast. If this happens, stay calm, call the police, and let these scammers explain their story to real authorities.

Unnecessary Repairs Suggested by Shady Mechanics

Why pay for car parts you don’t need? Some mechanics may see a senior driver and view it as an opportunity for extra profit. They might suggest replacing perfectly functional brakes or pushing for a “battery upgrade” that isn’t necessary. Before approving any repair, ask for specifics or a second opinion.

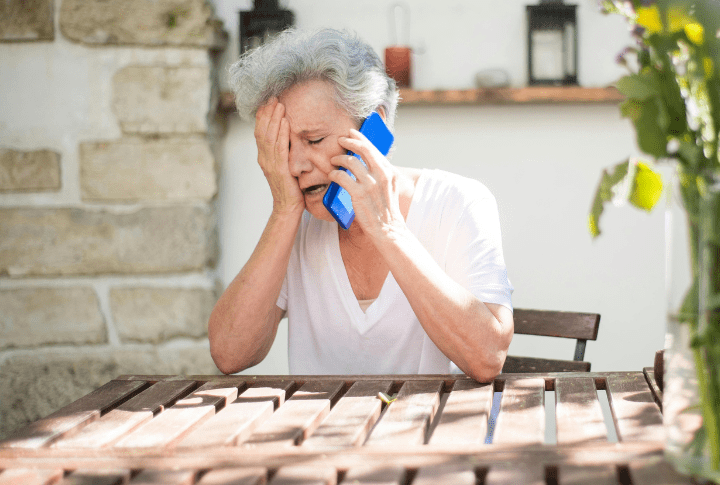

Phony Warranty Calls Claiming “Last Chance”

These callers can be persistent, claiming to have “urgent” news about your car’s warranty expiring. All they need is your credit card information to extend it. Spoiler: It’s a complete scam. Hang up, and if you’re concerned about your warranty, reach out directly to your car manufacturer.

Fake Parking Tickets with QR Codes for “Convenience”

In busy parking lots, scammers leave official-looking tickets, complete with QR codes for “easy payments.” The code leads straight to a phishing site that collects your details. So, if a ticket looks like it was handed over out of the blue, verify it with local parking enforcement.

Overpriced Parts and Labor Fees for Simple Fixes

There are repair shops that can’t resist charging double for standard parts or basic labor, especially when they think a senior won’t catch on. The simplest tire change or brake check suddenly doubles in price. In this case, compare estimates and demand itemized bills from them.

Fake Rental Car Offers Following “Accidents”

Another credit card fraud is when a person calls you after a minor car accident. They usually pretend to arrange a rental at the insurance company’s expense. But the truth is, they need your credit card PINs under the guise of placing a “hold.” In reality, genuine rental arrangements always go through your insurance.

The “Bait-and-Switch” Trick at Dealerships

Some dealers have mastered the art of the “bait-and-switch.” You’re drawn in by a great deal, only to find the cheap model is “out,” and pricier options are pushed. This is the time to stand your ground—make it clear you’re not interested in paying more than the advertised price.

Engine Light Reset to Hide Real Issues

Unscrupulous garages may reset warning lights instead of fixing actual problems. That’s because they want you to think repairs are done. The issue will inevitably reappear after a few days, and you’ll be stuck paying for it again. So, always request a diagnostic report to ensure real work is completed.

Extra Charges for Routine Inspections

Avoid shops that inflate inspection fees with hidden “safety checks” or unnecessary services, as they often take advantage of seniors who may not question it. That’s when a basic inspection suddenly comes with an inflated bill. To protect yourself, always request quotes upfront and check online reviews before making a decision.

Fake Repossession Agents Trying to Seize Your Car

A truly brazen scam involves actors posing as repossession agents, insisting your payments are overdue. They’ll even demand your keys. If they ever knock on your door, remember that actual repo agents follow legal processes, while these fakes rely on intimidation. Don’t hesitate to call your lender right in front of them to verify the situation.