10 Car Loan Mistakes Everybody Makes

Driving off the car lot with a new vehicle is the best feeling ever. However, everything that comes before that can be a bit of a nightmare. Anyone who’s dealt with car sales before knows just how stressful it can be. Just when you think you’re ready to finish, you get hit with another paper to sign. Here are some tips to help make the process easier and avoid costly mistakes that will haunt your wallet for years to come when dealing with car loans for your new vehicle.

Don’t focus on the car loan monthly payment

When you finance a car, monthly payments are unavoidable. You shouldn’t be focused on how much you’ll owe each month, however. According to U.S. News, “A talented salesperson can manipulate the numbers to get the payment as low as they think you need it to be. Often, they’ll extend the car loan to ridiculous lengths to do so.”

Shop multiple lenders

This is especially true for first-time car owners. The first deal you get is probably not going to be great. Thankfully, there are plenty of lenders out there who will be willing to work with you. Shopping around before walking into the dealership means that if the dealer wants to be your lender, they have to step up their game. Also, make sure the loan is truly approved before you go, so you don’t end up with a loan that falls through.

Don’t roll your existing car loan into a new one

A car dealer may act like they want to pay off your existing loan so that you can buy a new car. IF that sounds too good to be true, that’s because it is. The dealer isn’t paying off your first loan. The reality is that the dealer rolls the first loan over into your new one. This will drastically increase the cost of your loan, and by extension, the interest rate. Even worse is the fact that while you’re paying for two separate vehicle loans, you only have one car.

Pick the right rebate

Car rebates and low-interest rates are a great way for dealers to tempt new potential owners in. It’s also a great way for you to save money if you pick the right one. According to Bankrate, you need to really do your homework about each specific rebate and the low-interest rate you are offered. Some are amazing and will save you lots of money in the long run. Others will cost you more than if you had avoided them.

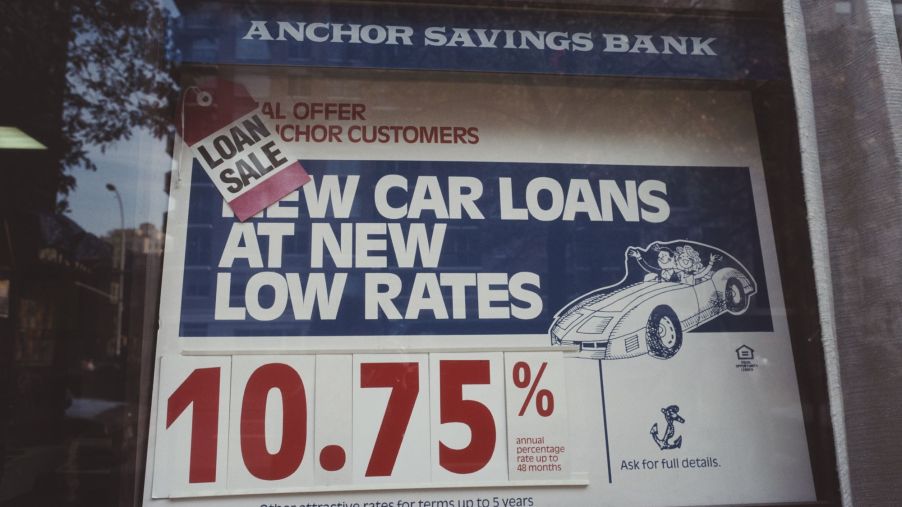

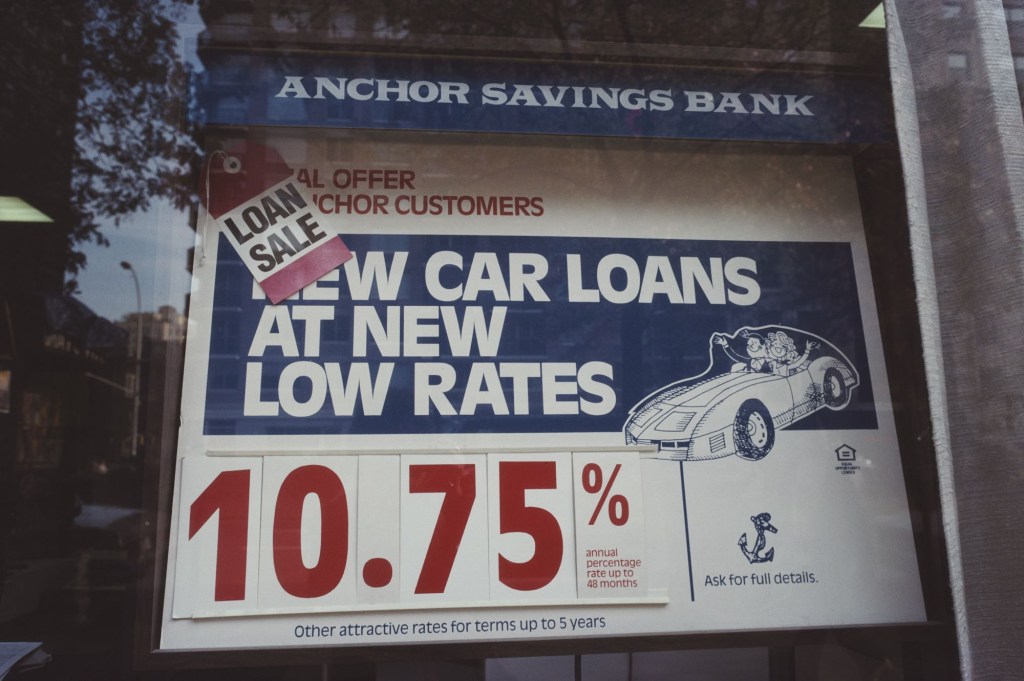

Refinance a high interest rate

If you’re already trapped in a bad loan agreement, you may feel stuck with it for the next few years. However, you don’t have to be. By talking to your bank or local credit union, you may be able to refinance the loan for a much lower rate that will help save you money.

Always read the fine print of a car loan

Everyone knows that car sales associates are the epitome of trust and grace, right? Now that we’ve got that joke out of the way, you need to read over anything placed in front of you carefully. Ensure that the price, loan, and interest rate you were quoted are the same as listed on the paperwork. If there is a blank space where the price should be, insist that it be filled out before you sign. This will prevent any confusion on the dealership’s part that they might be slow to fix.

Walk away from a bad car loan deal

Some deals stink from start to finish. The good news is that there are other deals out there. Don’t be afraid to walk away, even if this is the vehicle you’ve wanted since you were a child. By showing that you won’t be pushed around, you may gain some negotiating powers. On the other hand, even if the dealer refuses to play nice, you can still find a car at another dealer who isn’t trying to make a quick buck at your expense.

Know your credit score

This goes for any loan, whether it’s for a home or a vehicle. Knowing your credit score helps give you a better idea of the loans you qualify for. Therefore, if someone is quoting you a very high rate for a model despite having a great credit score, you’ll know to walk away.

Skip financing

If you’ve ever had a credit card, you probably know the pain of high-interest rates. The same thing applies to financing. If you can save up the money and pay cash, it’ll save you a lot in the long run. You can do this by essentially paying yourself the same car payment you would be paying a lender.

Don’t extend the life of a car loan to avoid higher payments

This goes hand in hand with taking a lower monthly payment. Yes, it seems cheaper on paper, allowing you to get the car you want. However, can you really afford this car? That’s the question you need to ask before you sign on the dotted line.

A car loan should not extend for six years or more. If it does, you’re paying a massive amount of interest, and you’re paying too much for the vehicle. Try looking at a cheaper vehicle or buying a used model of the car you can’t live without.