You’re Seriously Underestimating the Power of Shopping Around for Car Insurance

When shopping for car insurance, it’s easy to get caught up in all of the confusing terms and other lingo that comes with it. You also have to consider factors like your age, driving record, and the type of car that you’re planning to insure, and then call up your insurance company to get the quote. However, there’s little more footwork involved. In fact, a recent study conducted by Money Geek shows that many Americans are severely underestimating the power of shopping around for insurance – in addition to other important factors.

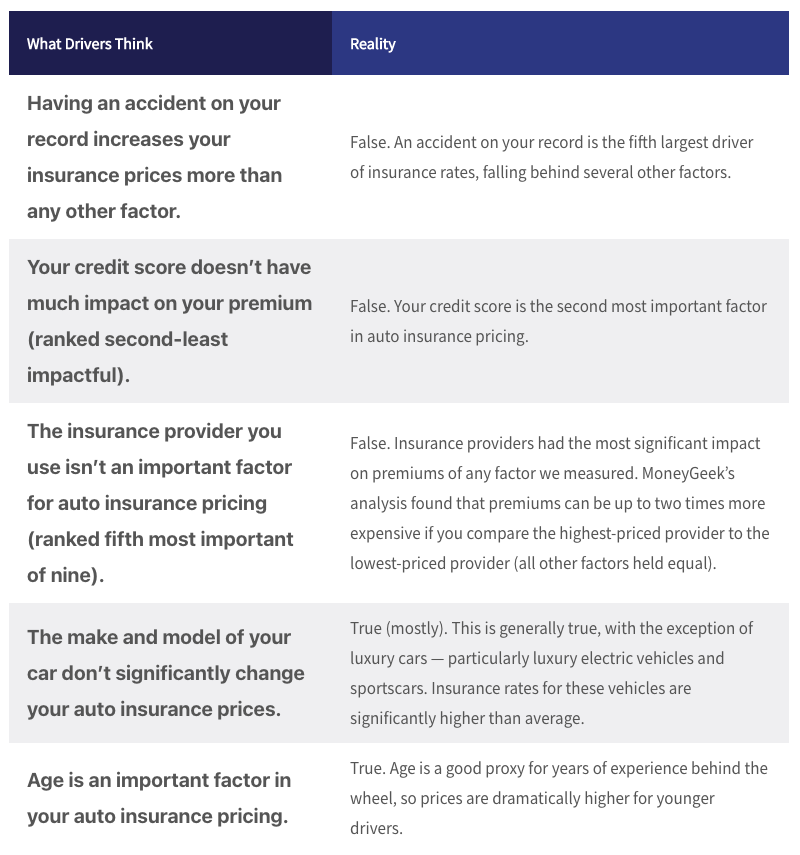

What drivers think factor into car insurance premiums versus reality

There are many factors at play when it comes to getting a car insurance quote. Most drivers know some of the basic factors that insurance companies use to generate premiums, but Money Geek’s survey found that there’s some confusion between what drivers think goes into a car insurance premium versus the reality of it.

Money Geek’s survey included 1,068 drivers and it found that many respondents “overestimated the impact of driving record (accidents, DUIs, etc.) and underestimated their insurance provider’s effect on cost.” Here is a table that shows some common misconceptions that drivers have about car insurance pricing versus the reality of the situation:

Consumers focus too much on their driving records and not enough on shopping around

As we can see, your driving record and age play a factor in your car insurance premium, but those aren’t the main factors. Money’s Geek’s study found that a 40-year-old man with a DUI paid less for insurance than a 19-year-old with a clean record. This is surprising considering most respondents, and drivers in general, think that their driving record holds the most weight when it comes to insurance premiums.

In reality, it comes down to what drivers can control in their premiums versus what they can’t. For example, Mark Fitzpatrick, senior content manager for Money Geek, says that where you live is going to have a major impact on your premium. Also, where you buy your insurance premium plays a big factor when it comes to getting the best rate.

Money Geek shopped the same driver parameters across nine different insurance companies. The result showed that drivers can save 33% on their car insurance rates by merely shopping around, while most consumers thought that only a savings of 23% were possible. In reality, shopping for car insurance can be your best friend when finding the lowest rate.

As a personal example, when I was shopping around for an insurance quote for my 2008 Honda S2000, one company gave me a quote of $180/month, while another quoted me $70/month with the same coverages. I bet you can tell which one I went with.

Your credit score does play a factor in car insurance as well

Another large factor when it comes to shopping for car insurance is your credit score. “Credit score is a huge factor (in most states). We know from downloading these quotes that if your credit score changes, then your auto insurance quote changes a lot. If you’re in a class of poor, or below-average credit, then your rates can really go up.” Fitzpatrick said. “Just like insurers have proprietary calculations for when someone gets into an accident and state ‘we’re going to multiply their rates by this much,’ they do the same thing with credit scores.”

So, while you might think that your age, driving record, and the car that you drive are the only factors when it comes to shopping for car insurance, they’re not. The next time you find yourself needing to buy car insurance, you might want to check your credit first and, more importantly, shop around for quotes. You could end up saving a lot of money.