SUV Model Proliferation Is Killing Demand From Within

SUVs and variations of SUVs are sprouting up everywhere. Small ones, electric ones, even ones called Mustang are flooding the market. Sedans are dead. It’s now a pickup truck and SUV brave new world. While the SUV dominance marches on manufacturers seem to be covering every sub-segment and variation to snag every possible customer. But, does the world need another type of SUV?

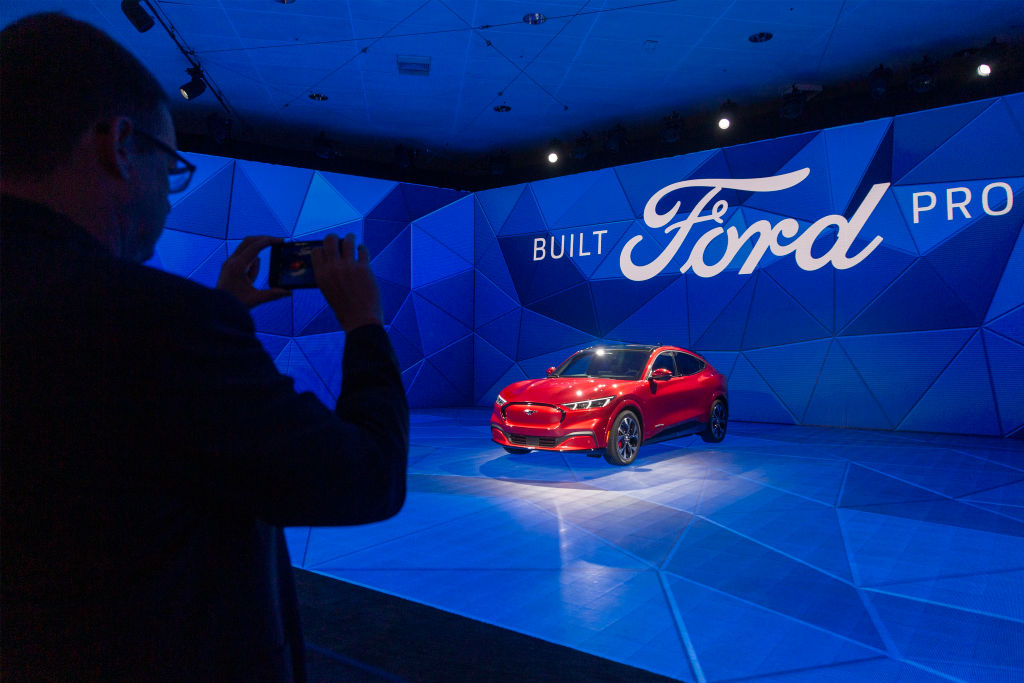

That’s a question the SUV manufacturers should be asking. Really, how many more iterations and sub-segments can SUVs conquer before consumers stop buying them? It’s one thing to have your first all-electric SUV. That’s big news. Ford debuted it last week at the LA Auto Show.

Almost 48% of all sales are SUVs

It’s also another SUV niche where there were none before. Almost 48% of all vehicle sales in the US are SUVs. Car sales have tanked, accounting for only 30% of market share and falling. That’s partially due to manufacturers discontinuing cars. 2020 will see the last of some storied nameplates like Impala and Malibu. The Ford Taurus is already gone.

But the reason they are killing off cars is that they don’t sell anymore. With the focus on SUVs it’s natural to do as it did with cars; try to outguess what every consumer wants in an SUV. That’s where we’re at now. It’s hair-splitting time.

Niche SUV segments are all that’s left

Automakers have covered a lot of ground conquering 48% of all vehicle sales with SUVs. What’s left are the niche segments. “We’re hitting the point at which the ceiling for SUVs has been reached,” says Edmunds analyst Jessica Caldwell. She told USA Today, “For automakers, it is a time in which you have to be a bit more strategic. You can’t just throw any SUV out there and it’ll do well because that’s how it felt for a while.”

The sporty SUV segment is an example of many manufacturers jumping into the segment when there really was not a lot of demand. Nissan’s Rogue Sport is a compact, slightly smaller version of its Rogue SUV crossover. It is sold elsewhere as the Qashqai.

It’s easy to see why Nissan looked at the Rogue for more variations. From average sales of around 100,000 at the beginning of the decade, it now sells over 400,000. In fact, it’s Nissan’s most popular vehicle in the US.

Finding more SUV demand for thinning demographics

Nissan says the buyer for a Rogue Sport is different and that it will appeal to “city-dwelling younger buyers” because it has a sporty appearance and state-of-the-art technology. Obviously, Nissan does not see this demographic among Rogue buyers. So, this is an effort to spread its appeal through a Rogue more specifically targeted at this group.

Not content to have a sporty SUV that’s also all-electric Ford took its most storied brand and hung its name onto the new SUV. It’s an SUV and it’s electric, so those categories alone mean lots of units will be sold. Did Ford really think it needed to anoint it as a Mustang?

A Mustang SUV. Really?

Some speculate because it’s a car that the Mustang won’t be around much longer. This was a way of continuing the brand’s aura, if not its specific configuration. Nonetheless many question the move arguing it dilutes the Mustang brand.

Since the Mustang Mach E won’t actually hit the streets for a year we’ll have to wait and see how it does and how it affects the Mustang brand. What we won’t have to wait for are still more SUVs and variations of the same.