The Most Frequently Asked Questions About Car Buying and Credit

Buying a car is a big decision and many inexperienced buyers tend to have a lot of questions about the process. But it’s not just the car buying process that can be confusing. In fact, there are many car shoppers that are inexperienced when it comes to credit in general. In order to help car shoppers navigate their way through the process, we decided it could be helpful to put together a list of the most frequently asked questions about car buying and credit.

What is a good credit score?

There are many different ways that the three credit bureaus (Experian, TransUnion, and Equifax) measure your credit. However, the two main credit scoring models are FICO and Vantage. Nearly every dealership that you visit will check your credit using the FICO 8 model whereas online credit sites like Credit Karma use the Vantage scoring model.

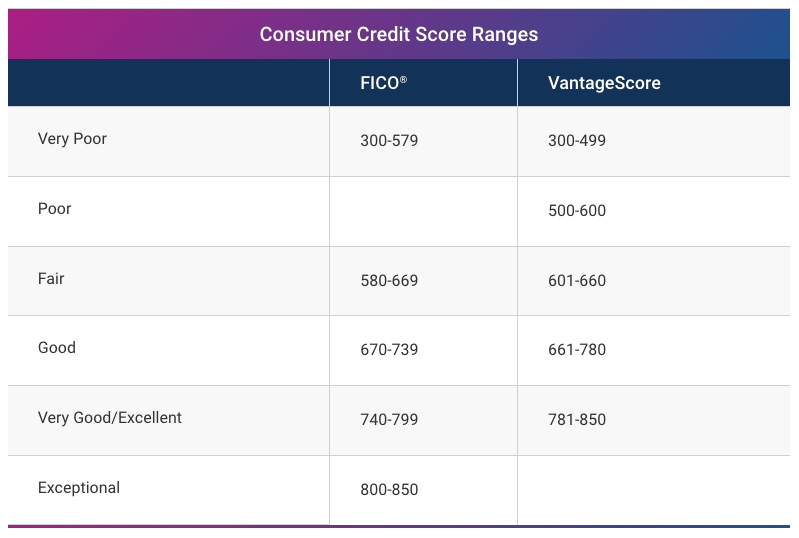

Here are the different score ranges for each model:

As we can see, a good credit score is between 670 and 739 on the FICO scale and 661 and 780 on the VantageScore. However, Experian notes that many banks consider a score above 700 to be good.

Why do I have so many different credit scores?

If you have received your score from different credit apps, websites, dealers, or banks, then you might be wondering why there are so many different credit scores. Experian laid out a few of the basic reasons as to why that is:

- Each of the three credit bureaus maintains its own credit history on you and that history can vary.

- FICO and VantageScore use different scoring models.

- Banks and other lenders use different algorithms to calculate your score.

Instead of paying attention to one score that you receive, a better rule of thumb is to look at your score as a range as opposed to a single number. For example, if you check your credit score using Credit Karma or your bank’s app, then they’ll like be fairly similar (728 and 735, for example). In that case, your score will likely be close to that when a bank or credit union pulls it when you buy a car.

What factors affect my credit score?

While different scoring models will have different criteria, there are five main factors that can affect your credit score:

- Payment history: Making regular on-time payments every month is important. As such, your payment history can make up for around 35% of your credit score.

- Credit utilization: How much of your total credit you’re using makes up for around 30% of your score.

- Length of credit history: How long you have had a credit history can make up for about 15% of your score.

- Credit mix: It’s not just about credit cards. The credit bureaus like to see a mix of credit lines including other auto loans, home loans, etc. The mix can make up for 10% of your score.

- New credit accounts: Any new credit accounts that you open up can affect your credit score by up to 10%.

Is leasing better than financing?

In some cases, yes. There are some major benefits when it comes to leasing a car versus financing it. According to Consumer Reports, some of those advantages include a lower monthly payment, a lower down payment, possible free maintenance, a new car with the latest safety features, and the ability to drive a new car every few years.

While you can definitely trade in a financed car every few years, there is a chance that it will have negative equity on it that you will need to deal with. However, if you lease a car, then you can trade it in at the lease end or walk away from it altogether.

How much of a down payment should I put on a new car?

In general, you should strive to put a 20% down payment on a new car and 10% down on a used car, reports NerdWallet. The more of a down payment you put in, the lower your monthly payment will be. Also, banks and other lenders like to see a larger down payment, if possible, to lower your loan-to-value ratio (LTV). Having a lower LTV can increase your approval odds as the bank will see you as less of risk of defaulting on the loan.

Is it worth it to purchase an extended warranty?

It depends on the type of car that you’re buying. For example, if you’re financing a German luxury car that you plan to keep for a long time, then it could be worth it to purchase an extended warranty. Many parts and repairs for German cars can get expensive, so purchasing an extended warranty can help

Otherwise, many car shoppers that have purchased an extended warranty when they bought their car never made use of it. In that case, it’s not worth the money invested in it. But if you purchase an older used car with plenty of miles on the odometer, then it could be wise to purchase an extended warranty.

Credit and car shopping

There is plenty of information when it comes to credit and car shopping and you can find a lot of it here on MotorBiscuit. We have covered everything from leasing, financing, trading, and selling cars. Check out our Car Shopping section for more.