How Does a Lease Buyout Work?

Car prices are through the roof these days, and in many cases, used cars actually cost more than new ones. For that reason, car buying has become somewhat of a challenge. However, if you happen to be driving a leased vehicle, you’re likely in luck. Buying out your car lease can be a wise financial move that can save you a lot of money over purchasing a different car.

How to do a lease buyout

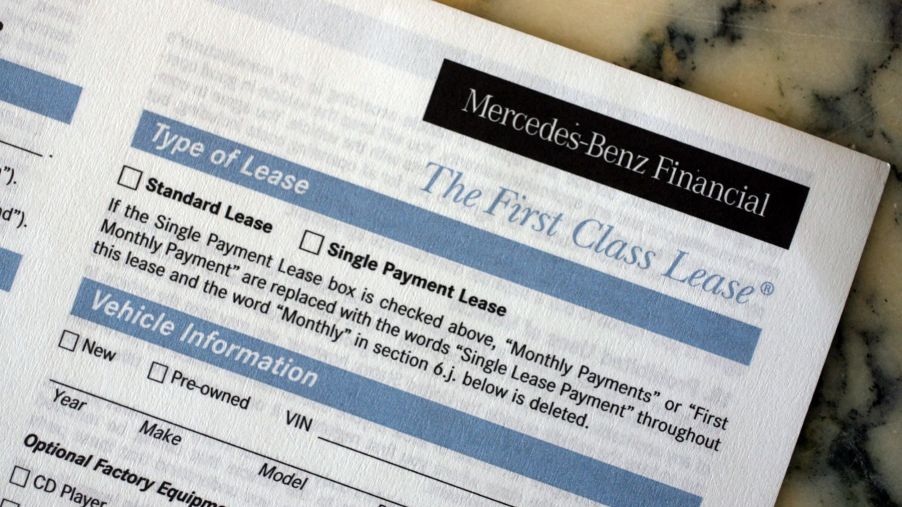

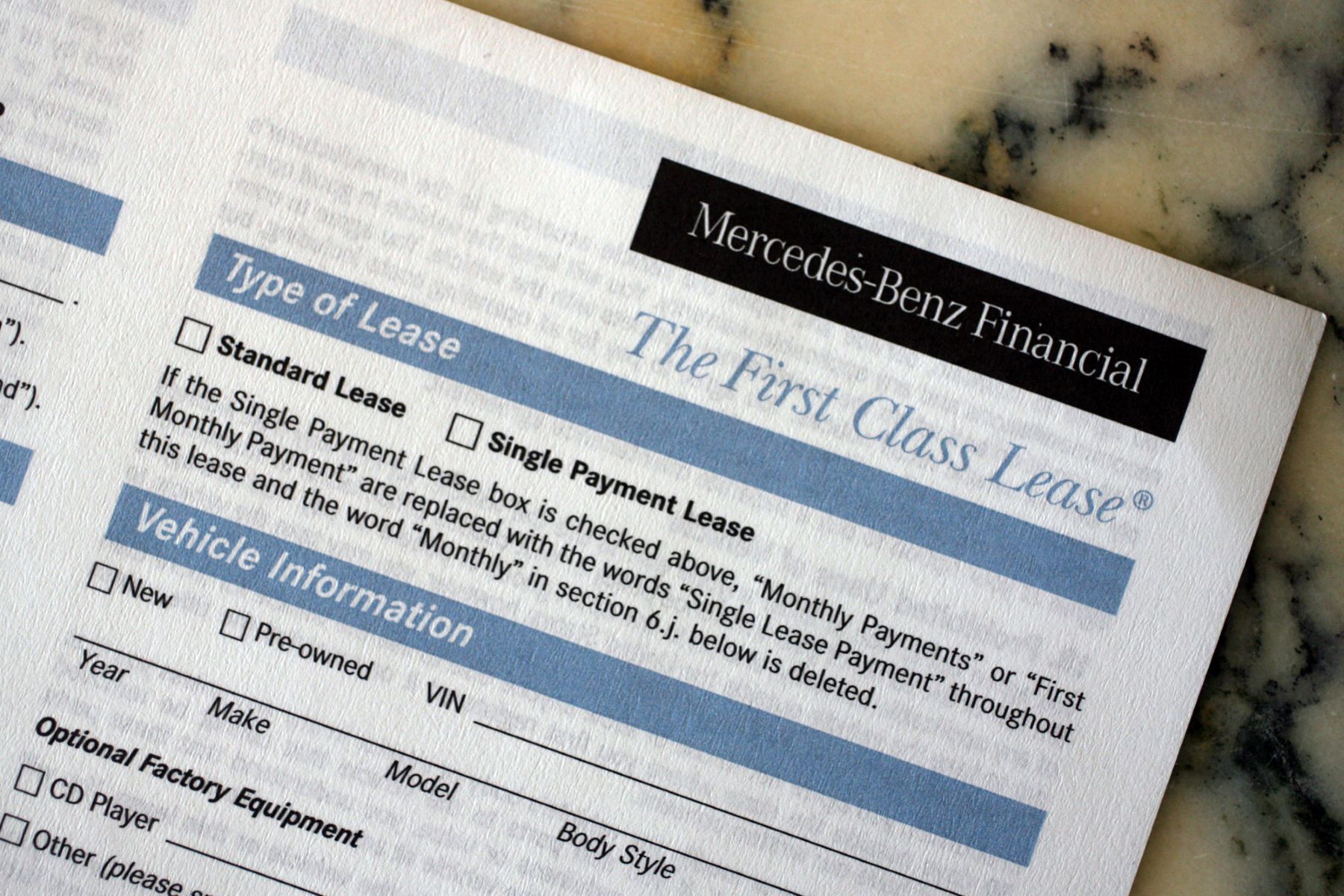

If you’re hoping to cash in on your lease by buying it out, there can be a couple of ways to go about it. In some cases, buying out your lease through the car dealer itself may be required. However, in other cases, you can deal directly with the leasing company.

If you must buy out your lease through the dealer, make sure to examine all of your paperwork carefully to make sure that you aren’t getting overcharged for any “processing fees.” Dealers will often attempt to charge these sorts of fees, making buying your lease out through them a more expensive option than going through the leasing company.

If your lease includes language that allows you to buy out your lease through the leasing company, that can often be a better option. Just call the phone number on your lease to discuss how to move forward with the paperwork.

A look at the ins and outs of lease buyouts

If you decide to buy out your lease, you will be expected to pay the “residual value” of the car, which is the depreciated value that the leasing company expected the vehicle to be worth at the end of your lease term. In some cases, you may even be able to buy out the lease before your term expires, although that can cost you extra fees, so you’ll want to examine your paperwork carefully to see whether an early buyout is permitted and what it would cost you.

In some instances, buying out your lease could also help you save on certain fees. For example, if you return your leased vehicle having gone over the permitted mileage or incurred some dents and scrapes, you’ll be charged fees to cover those costs. However, if you purchase the vehicle, you can generally avoid these sorts of charges.

You might also be wondering whether you could finance a lease buyout. The short answer is yes. Financing is available for lease buyouts, just as it is for other types of vehicle purchases. You can finance through the dealer or through other financial institutions. It’s always a good idea to shop around for the best rate, considering what sort of monthly payment you can afford.

Is leasing a good idea these days?

Nexstar recommends buying out your lease as a great financial move these days. Because let’s be real: today’s used car market is crazy. At the beginning of 2022, used car prices were 35% higher than they’d been at the beginning of 2021.

That means that in many cases, a used car’s actual value is far higher than the residual value written into the lease pre-pandemic when these recent surges in prices could not be foreseen. If you can take advantage of the price difference between your leased car’s residual value and its current market value, you’ll be sitting pretty.

Once you have the vehicle in hand, you can decide whether to resell it for its higher value or continue to drive it and take advantage of the savings. Just keep in mind that if you sell it and try to use your profit to buy a different vehicle, that vehicle will likely come at an inflated price, thus eating up your savings.