Here Is How to Buy a Used Car For Under $20,000 With Bad Credit

Finding a good used car and then going through the whole process of buying it can be a daunting process, especially if you have bad credit. There are plenty of good used cars to be had, but you might end up paying a lot more than you should if you’re not privy to the car-buying process.

Fortunately, professional auto brokers, like Ari Janessian, are willing to educate us on how to get the best deal possible. He even broke down the criteria for buying a used car from $15,000 to $20,000 for buyers with bad credit.

What most dealers will require when buying a used car

While most car dealers are willing to work with buyers that have bad credit, or even no credit, it’s important to know that they are usually looking for a certain set of criteria to get you financing from a bank. And while certain situations can call for different requirements, some of the basic criteria are the same.

According to Janessian, if you’re looking to purchase a used car, then any lender will require these stipulations whether you apply directly through them or via a dealership:

- Down payment equal to 20% of the selling price of the car: So if you’re buying a $20,000 car, then it’s optimal to have $4,000 to put as a down payment

- Three months of pay stubs: The banks want to see that you’ve been working your job for a while and that you can comfortably afford the monthly payments required for the loan.

- The monthly payment for the loan is no greater than your weekly paycheck

- You have a “debt-to-income” ratio of 40%: This means that your outgoing debt is no more than 40% of your monthly income

- At least a 580 credit score: This is usually based on your FICO 8 credit score, not the one that you look at on Credit Karma every day

Being able to meet these criteria will put you in a better place to be able to obtain a used car loan, however, your results may vary depending on your specific credit situation and the type of car that you’re buying.

If you’re going to apply for a loan, then we suggest applying with your personal bank or credit union first as they may have the lowest rates for you. While applying through a dealership can have the benefit of convenience, dealers tend to mark up the interest rate in order to make a little more profit on the deal.

Used car search criteria

When it comes to searching for the right used car for you, it’s easy to get tempted by the super-low pricing of 10-year-old luxury cars like BMW and Audi, as they are typically priced below $10,000.

Don’t fall for it, instead try searching for a newer and more reliable car since the extra money that you’ll spend for it will be worth it in the long run, since you won’t be troubled by any possible luxury-car repairs.

Here is Janessian’s search criteria for finding a good used car:

- Pick a car that’s three-years-old or newer

- Pick a car with no more than 36,000 miles on the odometer

- Look for cars that are known to be reliable and could be easier to sell later on

If you need any help with some good used car examples, here are 10 car makes and models that Janessian recommends:

- Honda Accord

- Nissan Altima

- Honda CR-V

- Toyota CH-R

- Toyota Camry

- Jeep Compass

- Honda Civic

- Toyota Corolla

- Subaru Impreza

- Nissan Rogue

Buying a used car with bad credit could mean higher interest rates

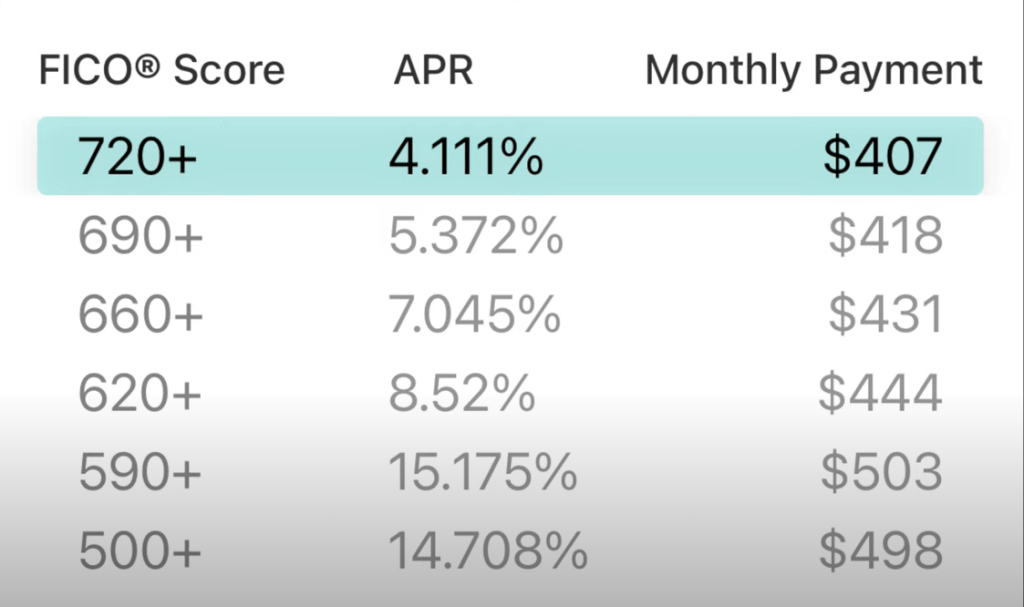

Lastly, when you finally find the car that works best for you and you meet all of the criteria needed to apply for a used car loan, just remember that your personal credit situation could lead to higher interest rates across the board.

Generally, used car loans carry higher interest rates than new car loans due to the higher risk that used cars have, however, they can be a little higher if you are in a bad or no-credit situation. Fortunately, if you can swing a higher monthly payment and pay off the loan by the end of the term, it will in turn boost your credit score. Best of all, you’ll own the car when it’s all said and done.