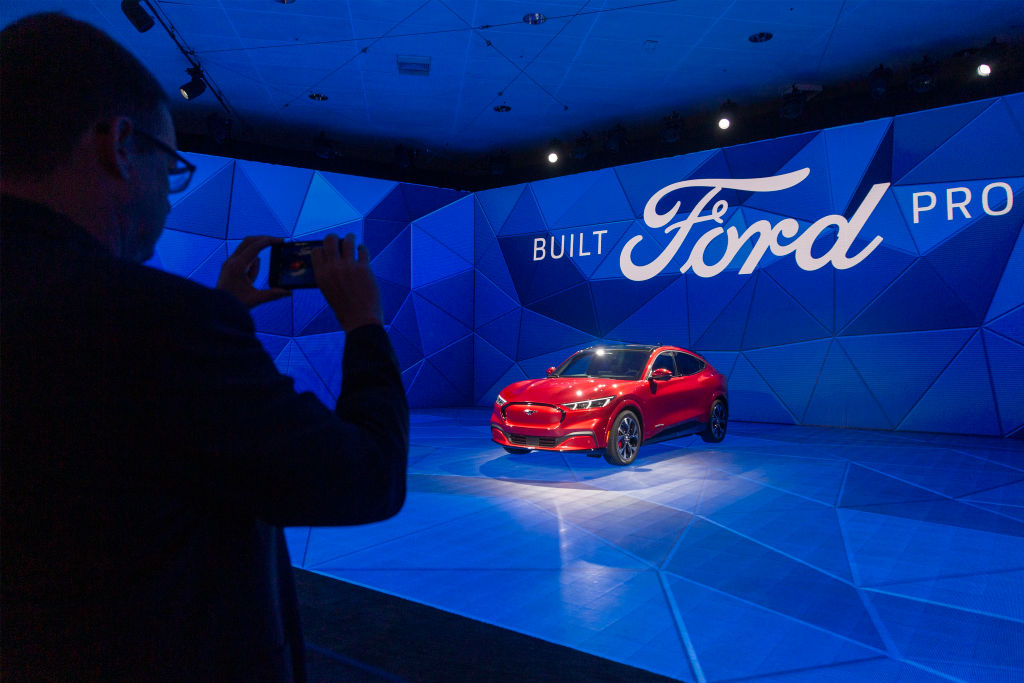

Ford Expects Mustang Mach-E Residual Values To Fall Badly

The Mustang Mach-E still isn’t out and Ford is already betting against it. Wait, what? Yep, Ford just released its bulletin of leasing residual values. What it says about the Mach-E is making eyes pop. Ford expects the Mustang Mach-E values to tank big. Like to 39% of MSRP after three years. Wow! What does Ford know that it isn’t telling customers?

The worst values for the Mach-E are the lower-priced Select and GT trims

That’s not all. The worst values for the Mach-E are for the lower-priced Select and GT trims. Higher-level First Edition, Premium, and California Route are only slightly better at 40%. Either way that depreciation rate is bad. As a comparison, the Tesla Model 3 retains 90% of its value after three years. What does that say about the Mach-E?

This info came from a member of the MachEClub forum. That huge drop in value is even worse than the Nissan Leaf and BMW i3 residual values. They lose 60.4% of their MSRP value after three years. That means only a 39.6 value in three years.

Is something else driving the low residual values?

So, what is going on here? Does Ford really expect those early Mustang Mach-E owners will be anxious to turn in their leased Mach-Es after three years? Or is something else driving the low residual values? We opt for thinking there is something else afoot.

If Ford factors residual values that low it can justify a higher monthly lease rate. In that way, it is making a lot more money off of these Mach-E leases. The higher monthly lease payments will offset the “lower” value when the lease ends.

Of course, “if” the value is higher than factored by the original lease payments then Ford gets a double win. It got higher monthly payments and is able to sell the Mach-E for more than it anticipated. We know that the Mach-E has been received very well and we wouldn’t expect its value to be less than 40% in three years. It has been so well received that the entire first year’s production is sold out.

Mustang Mach-E has lots of features that keep it more than competitive

Deliveries are supposed to start right after Thanksgiving 2020. Expectations are high and the Mustang Mach-E has lots of features that keep it more than competitive. For instance, its range is good, the batteries are liquid-cooled, the price is relatively inexpensive, and everybody seems to like how it looks.

Besides the Bronco the Mustang Mach-E has been one of the most highly anticipated vehicles coming in 2021. So, is Ford ready for owners to be massively let down, or is it looking at residual values as a way to bank a few more Benjamins? We won’t know for sure until leased Mach-Es start getting turned in.