Is It Ever a Good Idea to Extend Your Car Lease?

If you’re considering extending your car lease, you may want to weigh your pros and cons. According to the website Cars, “Most automaker finance units and third-party financial institutions will grant a one-time extension of a car lease past its end date by a fixed number of months (generally 12 or fewer) or on a month-to-month basis to a maximum allowance, though whether it’s a good idea depends on your situation.”

We understand you may want to continue to drive the vehicle you’ve grown to love. However, before you decide to extend your current lease and call the lender to request an extension, you’ll need more information about the insurance terms and procedures.

What are your options at the end of a car lease?

Aside from extending the car lease, you can do a lease buyout, according to the website Cars. That means you will buy out your current lease and be the official owner.

There’s also the common option of returning the vehicle and leasing or financing a new one. Additionally, if you need to terminate your lease early, it’s not uncommon for drivers to transfer the lease.

Pros of extending a car lease

A lease extension may work in your favor. Here are some of the reasons why:

- You may not need to pay any additional fees.

- You will have a couple of months to decide which new car, truck, or SUV you want to lease or finance next.

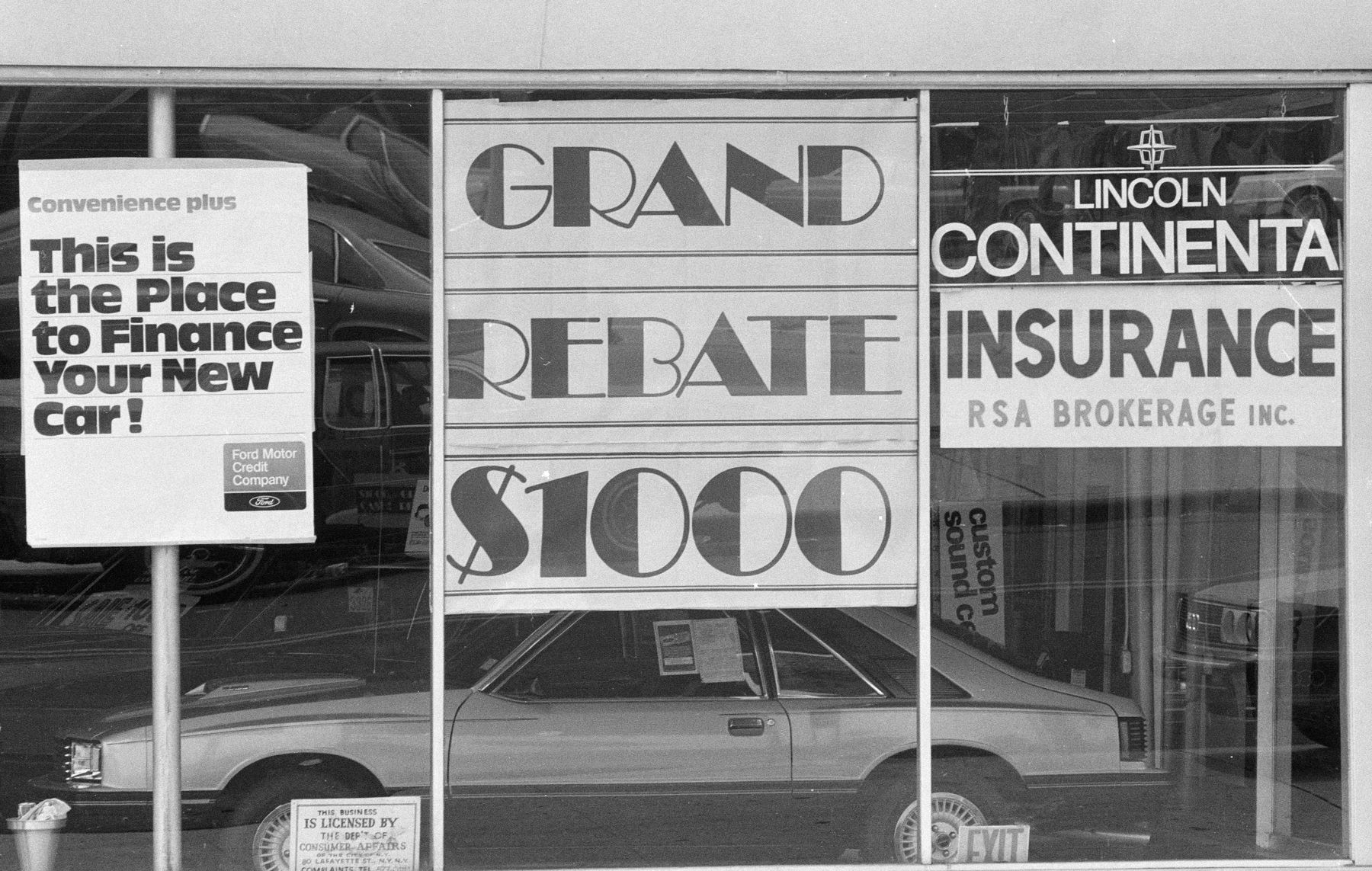

- You can see if there are any incentives or lease deals later in the year.

- You will have extra time to save for a down payment on a new vehicle lease or purchase — you can also weigh the pros and cons of leasing vs. financing.

Cons of extending a car lease

Of course, there may be some reasons why extending a car lease isn’t the best idea. Here are the downsides:

- You might need to pay extension fees.

- Some lenders will not reset the residual value in the contract even though your car continues to depreciate. If you decide you want to buy the vehicle eventually, you won’t be getting as good of a deal later. Plus, you’ll be wasting money making the additional lease payments.

- Some lenders won’t add an additional mileage allowance with an extension, so you may have to pay fees.

- Any gap insurance you bought at the dealership may expire with your original lease-end date.

- Your vehicle warranty may expire through the extension period, so you will have to pay out of pocket for any repairs.

What should you do at the end of your lease period?

The answer to this question depends on your situation. If you’re unsure if you want to finance or lease a new car, you may wish to extend your current lease, so you’ll have more time to think about it. If you’re not prepared for any additional fees, it might be best to turn in the vehicle once your contract is up.