Don’t Get Scammed! How to Spot Shady Car Dealership Deals

Car shopping can be extremely stressful. This is especially true when buying from a used car dealership. Let’s face it; used cars sales associates have a certain stigma. While most of them are lovely people, there’s always a handful of bad ones that make a bad name for the rest of them. There are plenty of sketchy dealerships that will do just about anything to a car to get it sold. So, shoppers should tread lightly when buying a car to avoid being scammed.

How to avoid getting sold a lemon and what to look for to spot a shady deal

CBS Pittsburgh recently reported on a shady dealership that lost its business license due to its sketchy ways. According to the news story, one customer was old a car that had its brake fail just two weeks later with children in the car. Another story outlines a rusty car having been “repaired” with duct tape and painted over to hide the damage.

Unfortunately, these kinds of situations are all too common. However, shoppers can take a few steps to ensure these predatory dealerships don’t sell them a car.

First and foremost, shoppers should always ask for a VIN report on the car. If there’s an accident or branded title in the vehicle’s history, a service like Carfax can shed some light on it. If the dealership refuses to hand over a report, that should be a big red flag. However, if they claim they cannot get it, shoppers can access VIN reports themselves. Simply reading the VIN off the vehicle’s dash and inputting it into a VIN history site can reveal any accident history. Furthermore, some are free, so this is not a step one should skip in the used car buying process.

To take it one step further, shoppers can bring the vehicle to a trusted mechanic for a pre-purchase inspection. Typically, these are not free. However, having a professional overlook the vehicle is the most sure-fire way to find problems. Again, if the dealership isn’t willing to allow an outside mechanic to inspect the vehicle, that’s a massive red flag. Worse yet, it’s a high risk of getting scammed. At that point, it’s best practice to walk away no matter how good the deal seems.

Bring your own financing to prevent overpaying

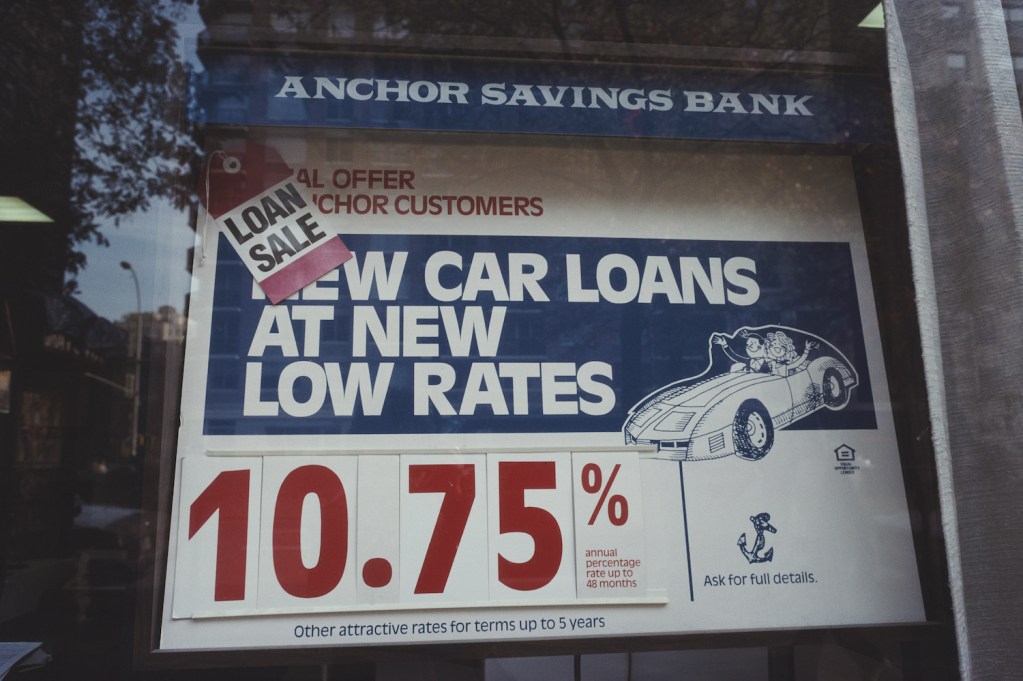

Even if the car itself is fine, dealerships may still try some trickery to get more money out of you. According to Fraud Guides, one of the most prominent examples is dealership loan kickbacks.

In a loan kickback, dealerships will bump a loan’s interest rate up to a number higher than you actually qualify for. So, if you sign the loan agreement, the providing bank gives the dealership a portion of the extra money generated by taking advantage of you.

Some dealers will also add a small amount to your monthly payment for various fees and charges that are entirely unnecessary. This is known as “loading payments.” Even if it’s only a little extra per payment, it could wind up being thousands going to the dealership for no reason at all.

Other things to look out for are extended warranty programs and “preparation fees” that dealerships know they can tack on to a loan to put more money in their pockets. Most extended warranty programs found from a used car dealer are not worth paying for. If you’d like an extended warranty, it’s best to source one externally from a more trustworthy source. Some vehicle manufacturers even offer them.

Overall, shoppers can avoid most of these price bumps by bringing their own financing. Getting a pre-approval from a trusted bank or credit union lets you know how much you can spend. Furthermore, it gives you leverage in purchasing. The ability to tell a dealership you have your own financing and will only pay what’s on the window is more powerful than one might think!

Shop smart, and don’t get scammed!

As unfortunate as it is, there are plenty of people out there who want other peoples’ money and will do just about anything to get it out of them. So, car shoppers need to play it safe and smart.

Keep these tips in mind, and remember not to let a sales representative pressure you into something you don’t want to do. Remember, you’re the deciding factor as to whether or not they make the sale. So, play your hand close and don’t do anything you don’t want to do!