Dealership vs The Bank: Which One Can Give You the Best Auto Loan Rate?

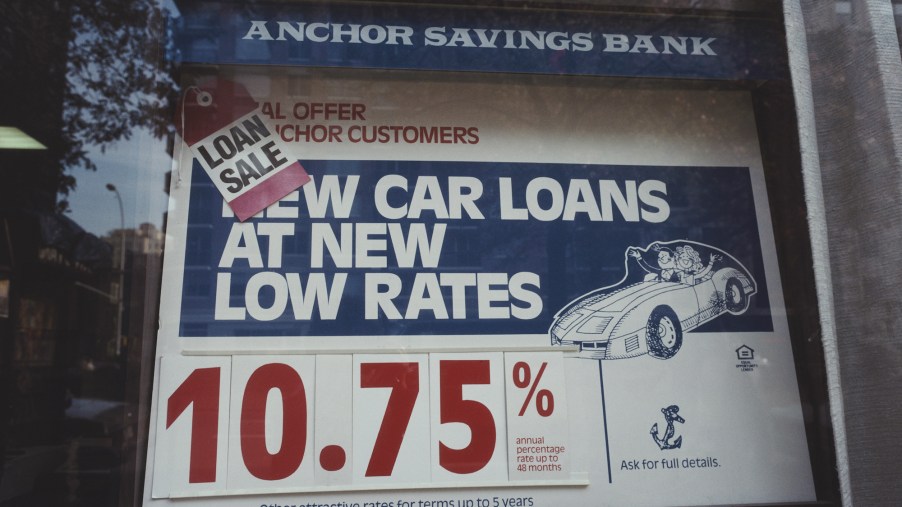

When shopping for a new car, it’s important to shop for an auto loan as well since interest rates can vary. And when it comes to interest rates, it’s important to get the lowest one possible. But which one can give you the best auto interest rate? The bank or the dealership?

A dealership can provide a lot of conveniences when applying for an auto loan

If you’re shopping for a car and need an auto loan, then the dealership that you’re working with might offer to find financing for you. If you don’t know what you’re doing, this offer can be tempting and you might even bite when the salesperson tells you that they will “find you the lowest rate possible.” We wouldn’t blame you for doing so, since the dealer can offer the convenience of a “one-stop” shop when it comes to looking for an auto loan.

Don’t get us wrong, the dealer really does shop around for you and gathers up different offers from banks and credit unions that they typically deal with. And while they may indeed find a low rate for you, it’s also possible for them to mark up the interest rate before presenting it to you. They do this in order to make a small profit off the deal, however, you can always negotiate the rate. In fact, just ask them to give you the “buy rate,” which is the rate that the bank initially gives them.

A bank can pre-approve you for a car loan

If you have the time and can put in the effort, then applying for an auto loan with a bank or a credit union can save you money on your interest rate. One of the advantages of applying with a bank is that you can get a pre-approval to get an idea of what your interest and loan terms will be with multiple banks and then pick which one works best for you.

Keep in mind that you will have to submit for the actual loan when you pick one and the interest rate can differ slightly when your credit is actually checked.

However, the advantage of applying for a loan directly with the bank or credit union is that you can find the lowest rate yourself and not have to worry about the dealer marking up the rate. Also, you will then be able to shop at the dealership as if you were a cash buyer with your loan approval in hand.

Which option should go with when applying for an auto loan?

If your credit score is on the lower end of the spectrum (640 or below), then you may be able to get approved easier by going with a dealership, since they usually have special relationships with the banks they usually submit credit applications to.

But if you have a higher credit score, then you could fare much better by going directly to the bank or credit union yourself. Keep in mind, though, that some banks might approve you directly even with a lower credit score, so it’s still worth it to check with them first and shop around.

Just remember that some used car dealers offer a “buy here, pay here” service in which they target poor credit customers and hit them with really high-interest rates for their in-house financing. Again, it could be tempting to go with this option, but it’s usually not worth it in the end.