The Cheapest Car Insurance Rate Depends on More Than the Car You Drive

There are many facets to buying a car aside from buying the actual car. You have to think about its registration fees, taxes, any repairs needed (if it’s used), as well as insurance for it. However, shopping for car insurance can be just as much of a hassle as shopping for the car itself. Fortunately, Money Geek made it easy by gathering up a lot of data on different insurance companies. Apparently, finding the cheapest rate depends on more than the car that you’re trying to insure.

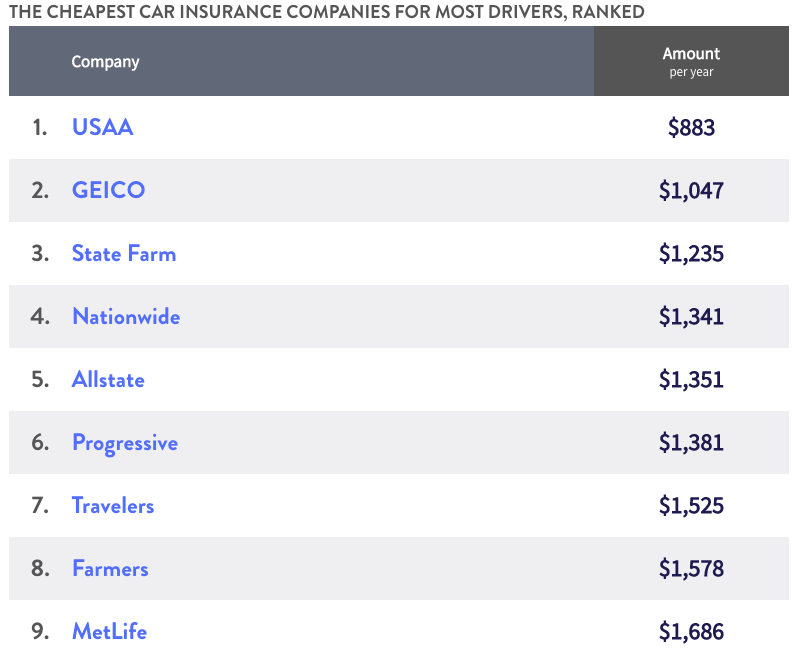

The cheapest car insurance for most drivers

When shopping for car insurance, it’s easy to get caught up in the different types of coverage, rates, etc. Also, car insurance rates can vary greatly from driver to driver as different ages, locations, and cars to insure can have a great effect on the rate. Money Geek knew this when collecting its data, so the universal coverage amounts for “full coverage” were as follows:

- $100,000 in bodily injury liability coverage per person

- $300,000 in bodily injury liability coverage per accident

- $100,000 in property damage liability coverage per accident

- Comprehensive and collision coverage with a $1,000 deductible

Using these parameters, Money Geek found that drivers can save an average of 27% off their insurance rate by simply shopping around. As such, the cheapest car insurance rate for most drivers across the board is from Geico with an average annual premium of $1,047, which is $300 less than the national average.

However, current and former military members can save even more money as USAA offers the lowest average rate of $883 per year. Here is how other insurance companies stacked up on their list:

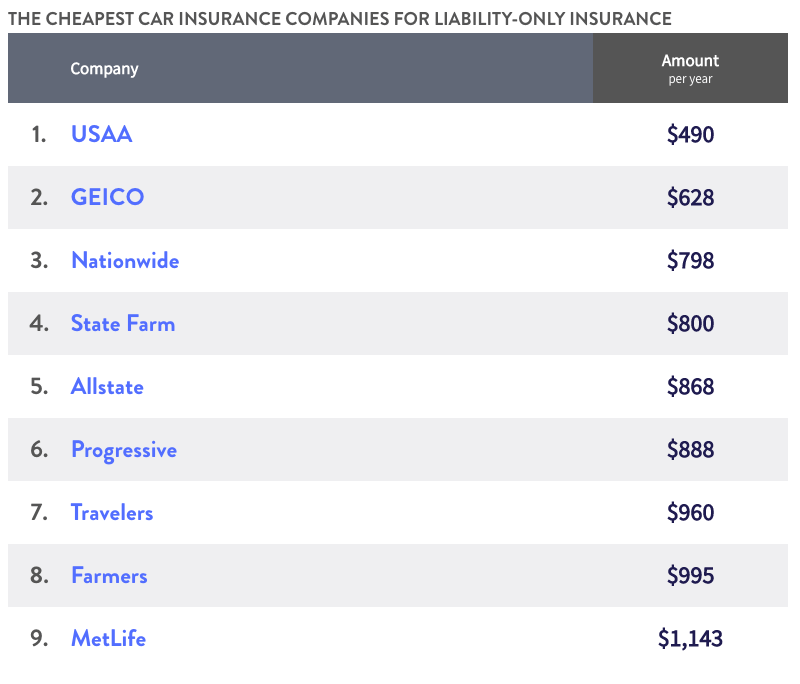

The cheapest car insurance rates for liability-only policies

While full-coverage insurance is highly recommended and required for new cars, it’s not always necessary if you drive a much older car. After all, what’s the point of having full-coverage insurance and a high premium if your car is only worth $1,000? Fortunately, Money Geek has you covered on the liability-only insurance rates as well.

They found that USSA members can get the best rates with an annual average of $490. But if you’re not a current or former member of the military, then you can still save a lot of money by going with Geico, which has an average rate of $628 per year. According to the list, Geico’s superb rates were followed by those of Nationwide and State Farm.

Here are the rest of the rates:

Tips for finding the lowest rate possible

Here are some money-saving tips when it comes to finding the best auto insurance rates possible:

- Raise the deductibles: The higher your deductible, the lower your monthly payment will be. For example, if you have the funds to afford a $1,000 deductible, as opposed to a $500 one, in the case of an accident, then opting for the higher amount will lead to lower monthly payments.

- Combine policies: If you’re able to combine your auto and/or home and renter policies, then bundling them up can save you some money every month.

- Lower your coverage levels: If you’re insuring an older car, then you can typically insure it with lower levels of coverage (or liability-only) to lower your monthly bill. But if your car is leased or financed, then your lender likely requires you to have full coverage.

Finding the best insurance rate for your car is almost as daunting as shopping for the car itself. With different coverages to learn about and different regions around the country, the insurance rates can vary greatly between companies. According to Money Geek’s results, it does look like Geico, State Farm, and Nationwide are your best bets across the board for the lowest rate.

You can check out the rest of Money Geek’s findings including the best rates for drivers with bad credit and the best rates for student drivers. Be sure to shop multiple quotes in your area to find the best rate possible.