Car Dealers Hate When Buyers Know These 5 Things

Buying a car from a dealership is typically a long process that’s filled with confusing lingo, numbers, and sales tactics. However, an educated buyer can reap the most out of their buying experience by understanding a few key details before signing the final contracts when purchasing a car. Zach and Ray Shefska – founders of YAA – recently released a YouTube outlining the five things that car dealers don’t want buyers to know. If you’re unaware of these key details, keep reading.

1. Car dealers hate when buyers know all of the dealership lingo

Do you know what “hold back,” “advertising assistance,” and “floor plan assistance” all mean? If not, it could benefit you the next time you’re sitting across the desk from a salesperson. In short, these terms are all ways that dealers make unseen profits off of the car that you’re buying.

Typically, if you throw these terms around when buying a car, you may be able to gain some leverage when it comes to discounts. But if you can’t, then you’ll at least look like you know what you’re talking about.

“Hold back, advertising assistance, floor plan assistance, even the full tank of gas that dealers put in the car. That’s all money that adds up. There could be, on a $50,000 vehicle, about $2,500 in additional profit above and beyond the $5,000 profit built into the car,” Ray said.

2. Knowing the “buy rate”

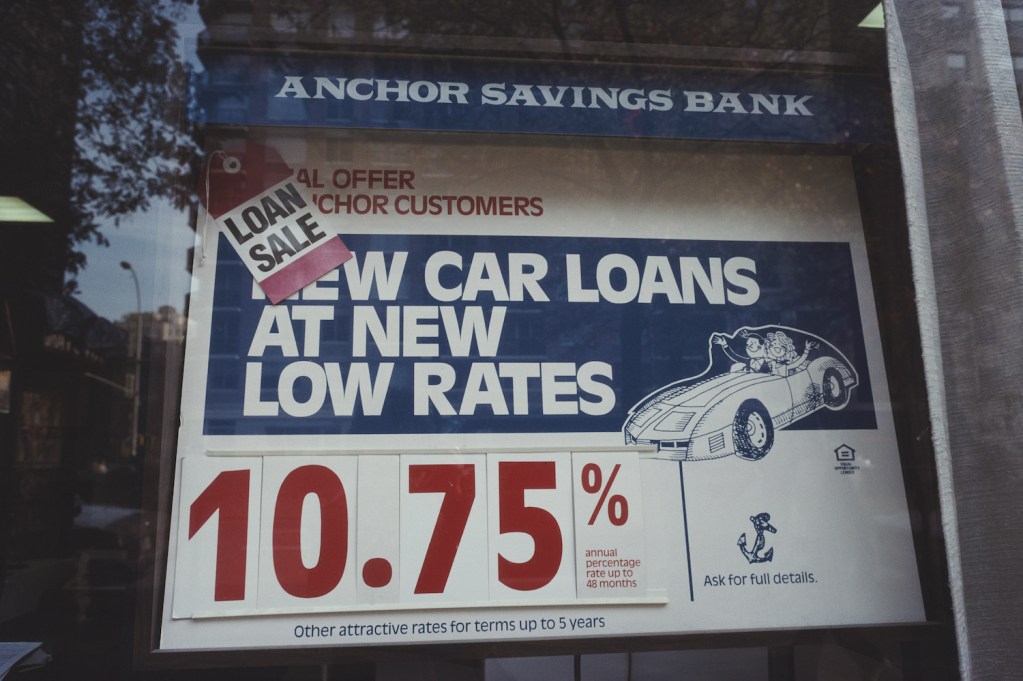

If you’re planning on financing a new or used car, we always recommend applying for an auto loan through your personal bank or credit union. These outside lenders will typically have lower rates than what the dealership will offer you if you apply through them. The reason for this is that when you apply through the dealership, they obtain the loan terms from the banks they work with and mark up the rate to make a small profit from it.

“If you’re arranging your financing through the dealership, that’s what is known as ‘indirect lending,’ you’re not going directly to the bank to arrange your loan, the dealer is arranging it for you. The dealer gets the approval and banks give the dealership the rate that they’re going to charge the dealership for the money that they’re lending,” Ray said.

“The dealership can then mark that rate up, that’s called the ‘sell rate.’ So you want to know what the ‘buy rate’ is. If you mention it, you’ll sound like a more savvy buyer.”

Not only will sound like a more savvy buyer, but you can also negotiate the interest rate down to save money over the course of your loan.

3. Ask for the invoice price

It’s no secret that car prices are through the roof nowadays as many dealers are marking up their new inventory above the MSRP. That means that getting a price anywhere below what is noted on the window sticker is pretty much futile. However, it can still be beneficial to know the car’s invoice price.

For the unfamiliar, the invoice price is what the car dealer pays the manufacturer for the car. And while you might not be able to buy the car for that price, it can still be helpful to know it.

“Talking about the invoice and getting your hands on the invoice is tactful and something that you should do,” Zach mentioned.

4. Understand the cost of the finance and insurance products

If you have ever purchased a new car, then you know that the pricing and negotiations don’t stop at the salesperson. They continue when you meet with the finance manager to sign the contracts as it’s their job to sell you the finance and insurance (F&I) products.

These are products like an extended warranty, exterior protection, GAP insurance, etc. And while their prices may look legit, just know that they are marked up. If you’re interested in any of them, then be ready to negotiate the price to get a better deal.

“The extended warranty in most dealerships is marked up 200 to 300%,” Ray said. “If it costs them $1,500, they might as you $3,995 for it. You have to understand that there is a huge profit margin in those F&I products and that each one of them has a specific selling price. Ask what the selling price is for each of them.”

5. Window etching is worthless

Speaking of F&I products, one product that is typically offered – or already installed on the car – is window etching. This is when the dealer “etches” the car’s VIN onto the window, which is supposed to help law enforcement identify your car if it’s ever stolen. Don’t fall for it!

“It means nothing, it leads to nothing. The police are never going to identify your vehicle because of the window etch IF they find your vehicle in the first place,” Ray said.

Car buying knowledge is power

The next time you buy a car from the dealership, it can be helpful to keep these five tips in mind. Check out our car buying articles for more helpful tips. Also, be sure to check out YAA for more car buying strategies and advice.