Can I Get a Car Loan With No Credit?

Buying a car, whether new or used, can be an especially daunting process if you have no credit history. Of course, if you’re planning to pay for a car in cash, then no credit is needed, but if you’re planning to lease or finance a car, then having some established credit matters. But what if you have no credit history, to begin with? Can you still get financed? Let’s take a closer look.

Be sure to check your credit history first

Before you work with a salesperson for the purchase of a car, we recommend that you check your credit first. You can use online resources like Credit Karma – or possibly even whichever bank that you already have an account with – to do so. If you have no credit history on file or have a “challenged” credit history, where you have possibly made some mistakes along the way, don’t give up hope.

Find financing through your own bank or credit union

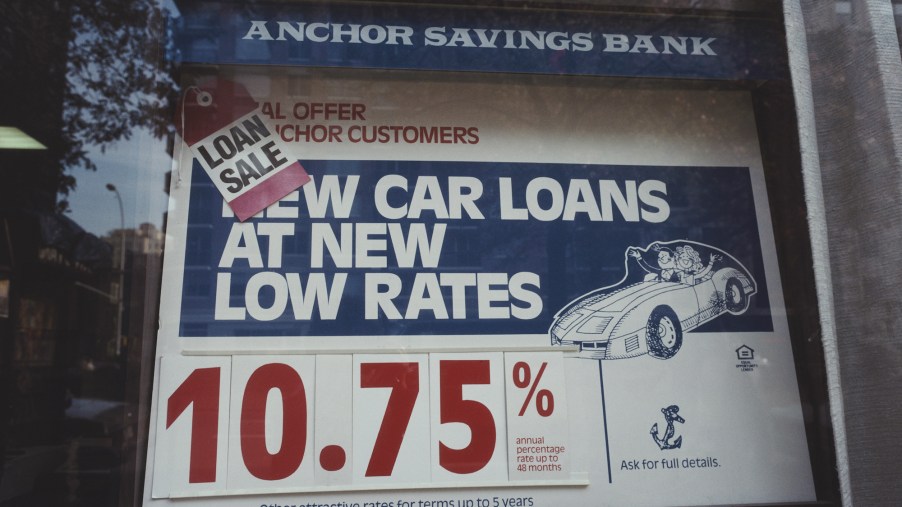

If you don’t have any credit history, then there are some options that you can explore when it comes to buying the car that you want. First, we would recommend contacting the bank that you have an account with and see what the current financing rates are, different banks will have different rates and they can also be different for new and used cars. You can also ask them if they will work with you considering you don’t have any credit. Most banks and credit unions will gladly work with you, especially if you’re already a current client with them (i.e. have a checking or savings account with them).

We always recommend checking with your own bank first as they might be more likely to get you approved at a lower rate. But just remember that if you’re a “first-time buyer,” your interest rate will likely be high no matter what since you’re considered more of a “risk” of not paying the loan back or on time. Although the interest rate might be high, just remember that a car loan is a great way to build your credit.

Find financing through the dealer

The other option would be to work with the dealer that you’re buying the car from and finding out what they can do for you. Getting financing through a dealer is often a much easier process as you can get the car and your loan in one stop. Just note that while dealers do often have special relationships with the banks and can possibly get you approved, they sometimes do mark up the interest rates in order to make a little more money on the deal.

The odds could be in your favor even more if you’re a recent college graduate. Many manufacturers, like Honda and BMW, have “recent college grad” programs that cater to college graduates that likely have little or no credit. These programs allow for an easier approval process and better interest rates.

Find a co-signer

If you find that you’re still not able to get approved through your bank or any of the dealer’s lenders, then the last resort would be to get a co-signer to co-sign for you on the financing. Just remember that the better the credit situation that your co-signer is in, the more likely it is that you’ll be approved and with a decent interest rate. Also note that the co-signer is going in 50/50 on the car loan with you, so if you happen to skip or miss any payments, it will hurt their credit as well.

Here is a professional tip

If you have a car picked out at a dealership and know that you don’t have any credit, then we recommend sending an e-mail to the general manager of the dealership and letting them know about your situation. Go on the dealer’s website and find the “About us” page and look for the general manager’s information.

General managers have seen all types of credit situations and they will likely be sympathetic to yours in order to earn your business. On top of all that, they typically have a much better relationship with the lenders that the dealer works with and will be in a better position to help you. And if they can help you, then they will also most likely set you up with the best salesperson that can suit your needs and your situation.